Weekly Update 01/25/26

The Year of Gaslighting: Why Your Charts Are Lying to You

Show your support by liking and restacking this substack to continue free substacks and discord access. Your engagement = my motivation to keep cooking.

Good Morning: Welcome to the Year of Gaslighting

Last week was, in a word, spectacular. Our analysis was a total chef’s kiss—we didn’t just participate; we dominated. We were packed, prepped, and ready to catch both the early-week dip and that sudden, news-driven spike that caught so many others off guard. If you followed along, you know it was a pretty phenomenal week.

But now, we turn our attention to the present. Welcome to 2026, which I have officially dubbed “The Year of Gaslighting.” This is the year where the market will attempt to create a crisis of faith in every trader’s head at least half a dozen times before finally giving a confirmation and continuing the move. We are entering a phase of sideways,

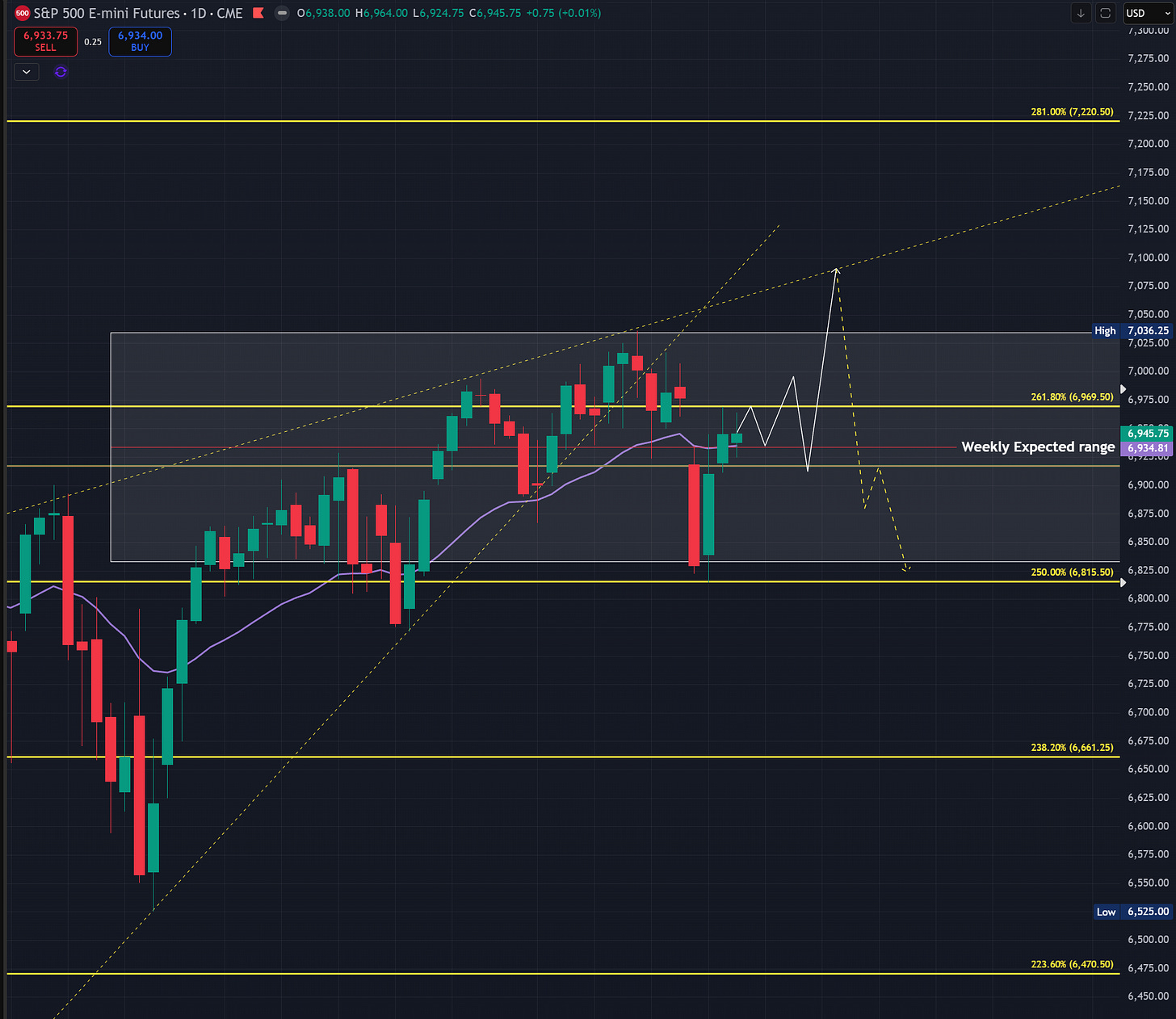

ES

Weekly expected range: 7034.44 - 6833.06

Our last week’s analysis on ES turned out to be absolute perfection. We were ready for the early week dip and that news-driven rocket ship that followed. For this week, the path I see for futures is once again range-bound and incredibly choppy. If you’re looking at the micro timeframe, expect some upside into Monday, followed by a quick “blink and you’ll miss it” dip on Tuesday.

This Tuesday dip is likely a gift; it should be bought up, leading to an upside continuation into Thursday. However, keep your guard up after Thursday—there is a high probability of a sizeable sell-off on Friday. But as you know, Fridays are notorious for being the “Hall of Fame” for traps. Looking at the bigger picture, I believe the dips we see this week are just the final setup for a new All-Time High on ES futures by February 3rd. After that peak, I expect the “risk-off” tape I’ve been yelling about to finally show up and ruin the party into the first week of March.

NQ

Weekly expected range: 26144 - 25216

The NQ analysis worked like a charm last week: dip Tuesday, rip Wednesday, and a Thursday dip that we happily bought into Friday. This week, expect a repeat of that gaslighting rhythm. As I’ve said, 2026 is the year where the market wants to create a crisis of faith in your head multiple times before finally delivering a move.

For this week, expect a small upside recovery on Monday followed by a decline on Tuesday. Post-Tuesday, we should be “risk-on” (upside) into Thursday, ending the week with a dull, downside-biased Friday. But post-Friday, I am seeing a serious breakout that leads NQ to either a brand new ATH or a test of the previous ATH (that dotted yellow line on your charts) by February 3rd. This will likely mark an intermediate-term top, causing the market to turn risk-off into March at the very least.

RTY

Weekly expected range: 2723 - 2619

The small caps are acting like that house guest who refuses to leave but also won't help with the chores. I’m expecting a test of the daily 21 EMA near 2629 by Friday. Honestly, I’m swiping left on this trade; shorting RTY prematurely is a great way to get your account rekt since small caps are almost always the last ones to join the rally. Momentum is finally starting to reverse, and for this week, I want to see every "rip" get sold off toward the lower end of the expected range by Friday afternoon.

YM

Weekly expected range: 49476 - 48884

The Dow has been living in its own dimension lately, completely disconnected from the rest of the market. This basically proves my rotation thesis. For this week, I’m looking for a slide toward the lower edge of the range early on. From there, we should see a decent upside bounce into Thursday. If YM gets over-excited and jumps out of its expected range (which I think it will), expect Friday to act like a hall monitor and drag it right back inside.

SPY

Weekly expected range: 699.82 - 678.84

For SPY this week, I want to see a Monday "feel-good" move followed by a sudden "get-rekt" downside trap on Tuesday. From that trap, I see us recovering back above the 688 level by Thursday, followed by a small fade on Friday. Like I’ve said, the market has to trap both the bears and the bulls before it can finally break this range. This final week of January is the perfect time for that drama. Post-Friday, I see SPY making a final push to a new ATH by February 3rd—the ultimate bull trap—before we head south into at least the first week of March.

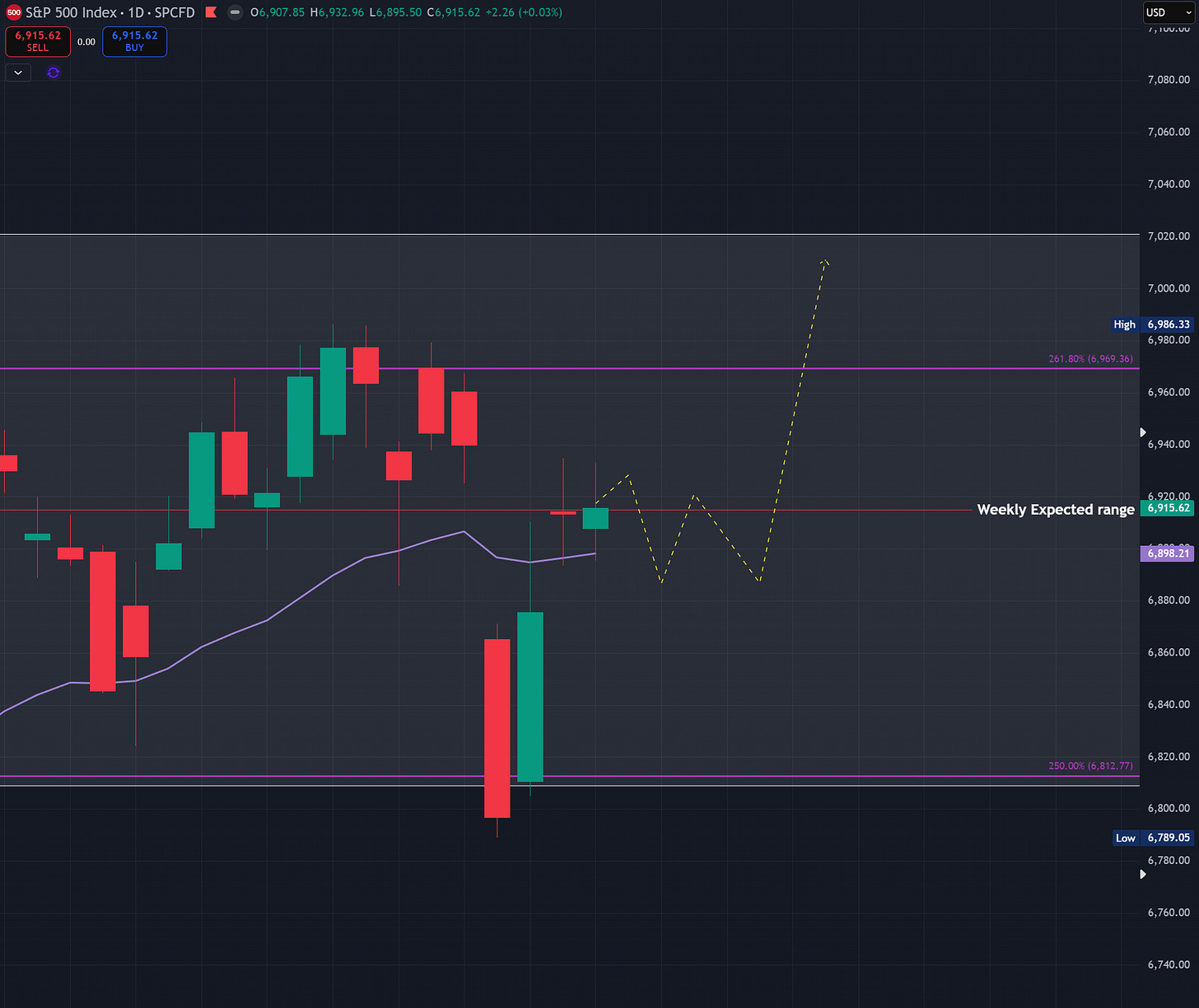

SPX

Weekly expected range: 7021 - 6809

The SPX setup is nearly identical to SPY, with a range that mirrors last week. We are looking for that coiled breakout trap. Expect some upside Monday, a good-sized downside move Tuesday, and then a continuation of the climb into Thursday followed by a boring Friday. Post-January, I am expecting a massive squeeze up into February 3rd. It makes sense to play this move, but keep your size small—this squeeze is the final siren song before a decent-sized down move into late February/early March. Don’t go full port unless you like living on the edge of a cliff.

QQQ

Weekly expected range: 634.86 - 610.58

I am specifically hunting for a “false breakdown” of the 620.92 level on the Qs. Once we dip below this and reclaim it, it’s off to the races (but keep your shirt on, it won’t happen all this week). On a micro scale, I want to see a decent open on Monday followed by downside acceleration into Tuesday. I expect us to spend some time below 620.92 before reclaiming it with strength by Thursday. This sets up a February sweep of the highs—the perfect time to start buying some insurance (hedges).

GC FUTURES

Weekly expected range: 5107 - 4858

Gold has been respecting a monthly parallel channel for decades—it’s more disciplined than my diet. We are closing in on our $5,000 target (which I called back at $4,200, you’re welcome). However, I’m seeing patterns on GC that suggest a good-sized down move is coming soon. While I wouldn’t recommend a heavy short here, you can play the correction via lottos if you’re feeling spicy.

VX futures

Weekly expected range: 19.89 - 16.97

Downside Monday, spike Tuesday. It’s almost too predictable at this point. After the Tuesday drama, VX should trend down until at least February 2nd. Mark that date on your calendar, because that’s when I expect the next volatility spike to hit and equities to take a sudden nap.

TLT

Weekly expected range: 88.9 - 86.96

TLT closed below its midpoint, which usually means it’s headed for the basement. Expect a downtrend into Wednesday or Thursday, moving toward the lower edge of the range which coincides with the parallel channel. Once we hit that floor, we should see a bounce back toward 87.93. Patience is key here; don’t chase it.

ZB Futures:

Weekly expected range: 116.15 - 114.16

Expect Monday red and a Tuesday “fake-out” green. That Tuesday move is likely a bull trap heading for the 113.28 level into the end of January. I truly believe a massive upside move is brewing very soon, and this final dip is going to be the “buy of a lifetime” opportunity.

CL:

Weekly expected range: 65.58 - 56.98

No real change in the oil analysis from last week. I’m still expecting some weakness into the end of January, followed by another rip. It’s oil; it likes to keep things dramatic and keep us on our toes.

USO:

Weekly expected range: 77.18 - 70.72

Same as CL. We already banked a 52% gain on our calls and trimmed. I’d like to see more downside, but shorting oil with the current geopolitical circus is a brave man’s game (and not the good kind). Just wait for the dips and go long.

NG:

Weekly expected range: 6.031 - 4.675

Natural Gas has been absolutely mental lately. We were long before that +27% overnight gap—hope you enjoyed the steak dinner! This week: upside Monday, a dump into Wednesday, and one more recovery into February 2nd. After that, I think the party’s over and we see a consistent down-move. Be patient on this one.

UNG:

Weekly expected range: 15.08 - 12.86

Upside early week, a dump mid-week, and a recovery into Feb 2nd. We are getting very close to a short entry here, but if you’re even a day early, it’ll wreck you. Don’t be the guy who gets stopped out before the real move.

BTC:

Bitcoin hit our turn date but still hasn’t reached that 83k level. I’m looking to go long tonight or tomorrow. I think BTC is gearing up for a fantastic rally into February 4th. Short-term dips aside, this move looks like it has legs until April, followed by a deeper correction through August.

NVDA:

Weekly expected range: 195 - 180.34

This week for NVDA looks like a big “nothing burger.” Up Monday, down Tuesday, and a failed recovery Wednesday. It’ll likely chop sideways into the end of the month. The real juice comes with a gap-up move and upside push into February 4th. You can probably sleep on this one for a few days.

TSLA:

Weekly expected range: 469.94 - 428.18

TSLA tested the mid-parallel channel and broke out like it had a rocket strapped to it. It might start the week a bit weak to test the upper edge of that channel, but from there, I expect a massive squeeze taking us toward that unfilled gap in the 472–474 range.

AMD:

Weekly expected range: 274.22 - 245.14

The squeeze is working perfectly. It might last until January 27th, but after that, watch out—the drop is coming, and earnings will likely hit the accelerator. I’m very interested in shorting this with month-out options for the post-earnings flush.

AMZN:

Weekly expected range: 248.31 - 230.01

Amazon is currently doing its best impression of a brick. No real change in the analysis here; expect range-trapping and frustration before the real move. Stay patient and wait for the technicals to give us the green light.

META:

Weekly expected range: 684.42 - 633.31

Our META analysis was goated—bottomed exactly on the date we called. Expect the climb to continue into at least February 4th, with earnings providing the nitrous boost the stock needs.

AAPL:

Weekly expected range: 255.09 - 240.99

Apple followed my downside map perfectly. It’s finally time to buy around Wednesday. Earnings will likely blow it out of the door to the upside. I’ll be taking a position in equity—no need to get fancy when the setup is this clean.

GOOG:

Weekly expected range: 340.03 - 316.83

Google is following the topping pattern to a T. It should head down into January 29th before a small bounce into Feb 4th. I’ll be going long soon because the projected upside here is actually insane. Mark the buy date as February 9th.

MSFT:

Weekly expected range: 480.03 - 451.87

Last week’s MSFT analysis worked beautifully. Looking for a quick dip early this week followed by an upside continuation that lasts through the first week of February. Clean, simple, and effective.

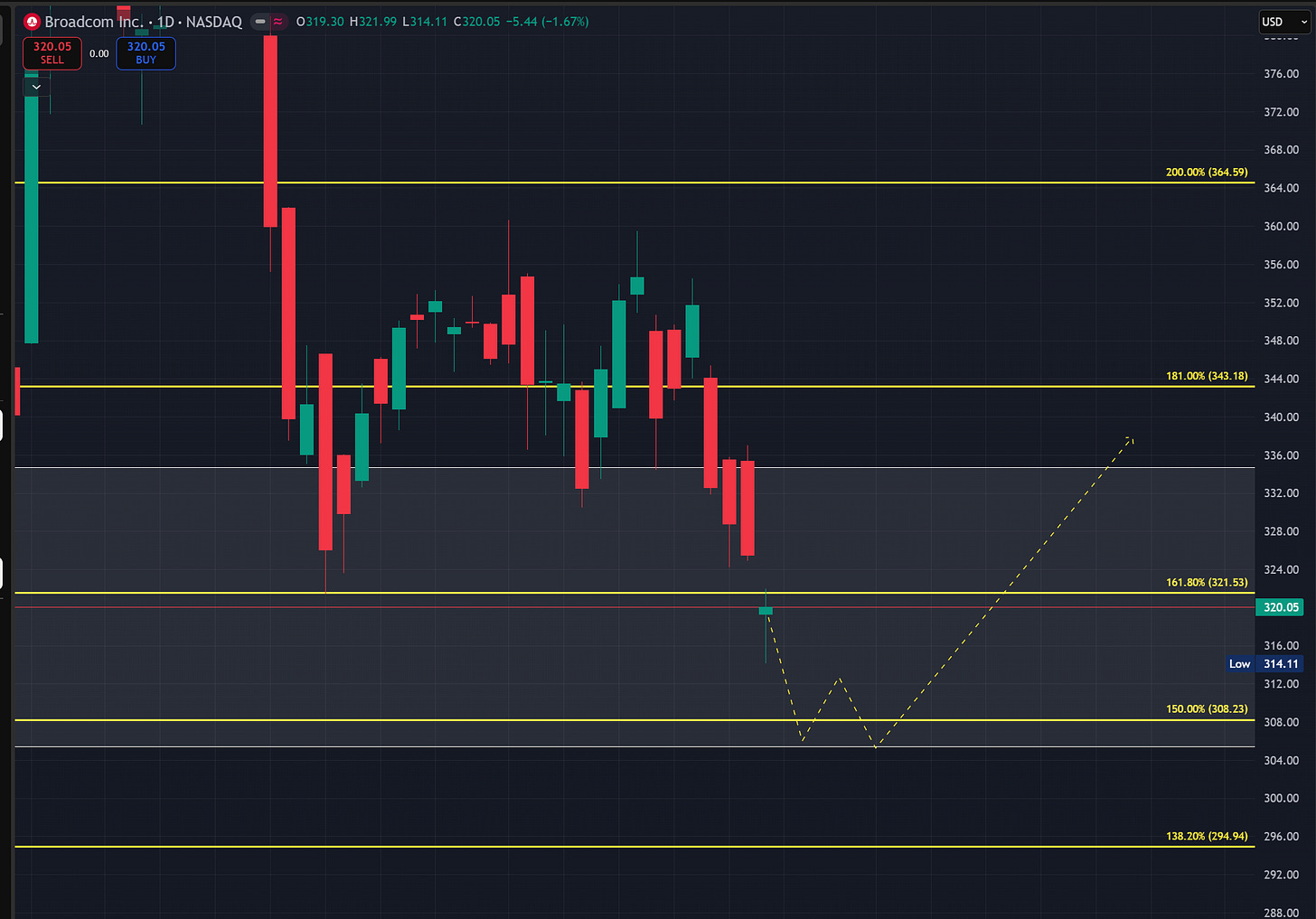

AVGO:

Weekly expected range: 334.66 - 305.44

Time to snipe the bottom near 308. Look for a false breakdown of that level; as soon as we reclaim it, we should be buyers. Expect downside into Tuesday, then a recovery into Thursday. We’re looking for a move toward 364.

NFLX:

Weekly expected range: 88.76 - 83.48

We finally snagged the 82.8 bottom and we’re already up 4%. The best is yet to come. Upside Monday, a dip Tuesday (which we buy), and strength into the end of the week.

As we enter the final week of January, please remember that the market’s primary job is to make you look like an idiot. This is the “Year of Gaslighting”—if you feel confused, you’re exactly where the market wants you.

Risk management is your only friend. Do not “full port” into these ranges thinking you’ve found the “one.” We are playing for the February 3rd ATH and the subsequent March correction. Stay chill, keep your stops tight, and don’t chase the spikes like a golden retriever after a tennis ball. Patience isn’t just a virtue; in this market, it’s your bank account’s only defense.

And just in case you forgot:

This is not financial advice, this is financial improv

Until next time,

Wicky

Wicky gems for a snowy day