Weekly Update 02/01/2026

Pascal’s Profit Factor: Why the Market is a Leap of Faith

Show your support by liking and restacking this substack to continue free substacks and discord access. Your engagement = my motivation to keep cooking.

Good Morning.

In the seventeenth century, Blaise Pascal argued that it is a better bet to believe in the divine than not, because the potential upside is infinite while the cost of being wrong is negligible. In the world of trading, we face a similar wager every Monday morning. We can choose to believe in our levels, or we can choose to believe the market is a chaotic vacuum designed specifically to ruin our lives. I choose the former. If I am wrong, I lose a stop-loss. If I am right, I am a genius until the next trade. It is simply logical to have faith in the process, provided that faith is backed by a profit factor of 24.22.

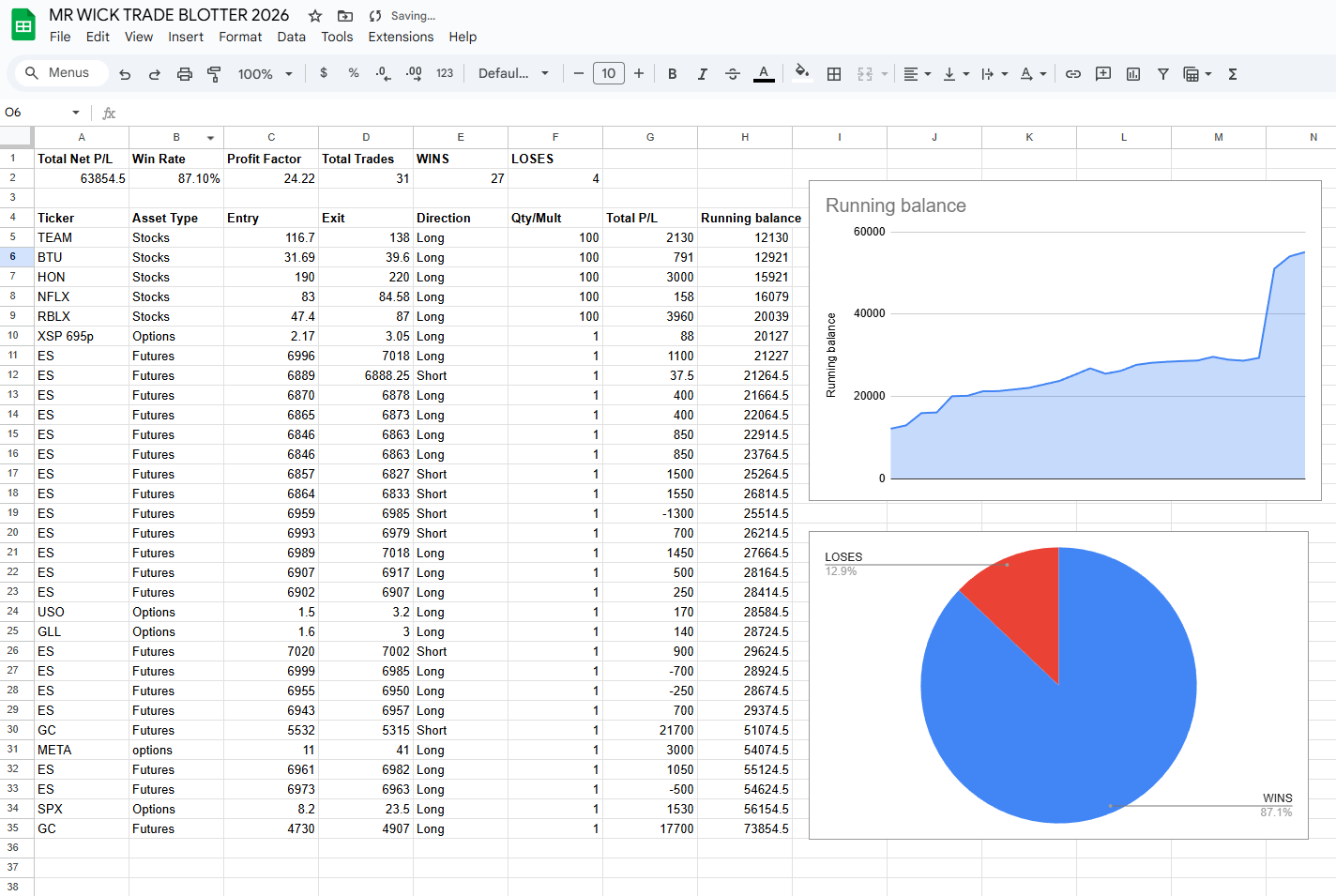

We have officially closed the book on January 2026, and looking back, our execution has been nothing short of phenomenal. With a win rate of 87%, I suppose we have done “decently,” if you consider total market dominance “decent.” I have attached the trade blotter below. I am still searching for a way to host this that doesn’t involve a direct spreadsheet link, but it will be updated daily regardless of my technical illiteracy.

ES

Weekly Expected Range: 7070-6853

As I have droned on about in past releases, every dip on the ES was a gift into the first week of February. We have played both sides of the tape, yet the week closed nearly flat—proving once again that the bears have the structural integrity of a wet paper towel whenever a dip appears. For this week, I am looking for a risk-on (BUY) regime into Tuesday. However, don’t get too comfortable; post-Tuesday, we likely see a downturn that persists until Thursday. Friday should bring a risk-on setup once more. My bias is that the current crop of shorts is about to get hunted early in the week, followed by a dump that will effectively liquidate the “breakout trader” gang. I am looking to initiate a short position this week.

NQ

Weekly Expected Range: 26153 - 25126

The NQ provides a much clearer picture than the ES, mostly because tech concentration makes it a far better vehicle for shorting. I expect a solid risk-on tape into Tuesday, where we will likely mark a local high before beginning a consistent grind lower into at least February 11th. I’ll be taking this trade via futures or short-term options, depending on how much I feel like gambling on Greek letters.

RTY

Weekly Expected Range: 2680 - 2573

Small caps followed our script perfectly last week, continuing their downtrend despite several pathetic attempts to rally. This week, expect some upside into Tuesday, followed by a swift rejection into Thursday. After that, RTY should return to risk-on territory, offering a safe window to buy dips into February 18th.

YM

Weekly Expected Range: 49543 - 48417

The Dow is developing a setup that could be described as “epic” if you enjoy watching price action oscillate. Upside into Tuesday, swift rejection into Thursday. If we test the lower edge of the weekly range post-Thursday, I expect a violent rally. We have a tight wedge on the daily; while it could be a fake-out, we are in the business of making money, not predicting the future with 100% certainty. We trade the chart, not our egos.

SPY

Weekly Expected Range: 703.5 - 680.5

SPY followed the analysis to the letter last week. For the start of February, expect upside into the 3rd or 4th, followed by a move lower to round out the week. As I’ve maintained since the ball dropped on New Year’s, this move is likely forming a short-term top ahead of a bearish move into mid-March.

SPX

Weekly Expected Range: 7050 - 6829

Much like the SPY, I want to see a “fake-out” move to the upside to kick off the month. Bias is up into Tuesday, followed by a decline into Thursday that likely catches a bid on Friday to close the week flat. If we test the 6779-6780 zone and hold, it’s a phenomenal buy. If we gap down there over a weekend, it is an immediate buy.

QQQ

Weekly Expected Range: 635 - 609

Similar to the NQ, I anticipate a rip into Tuesday that leads into a delightful short lasting until February 20th. Tech looks ripe for a pullback, and I intend to harvest it. We can predict all we want, but eventually, we have to trade what is actually on the screen.

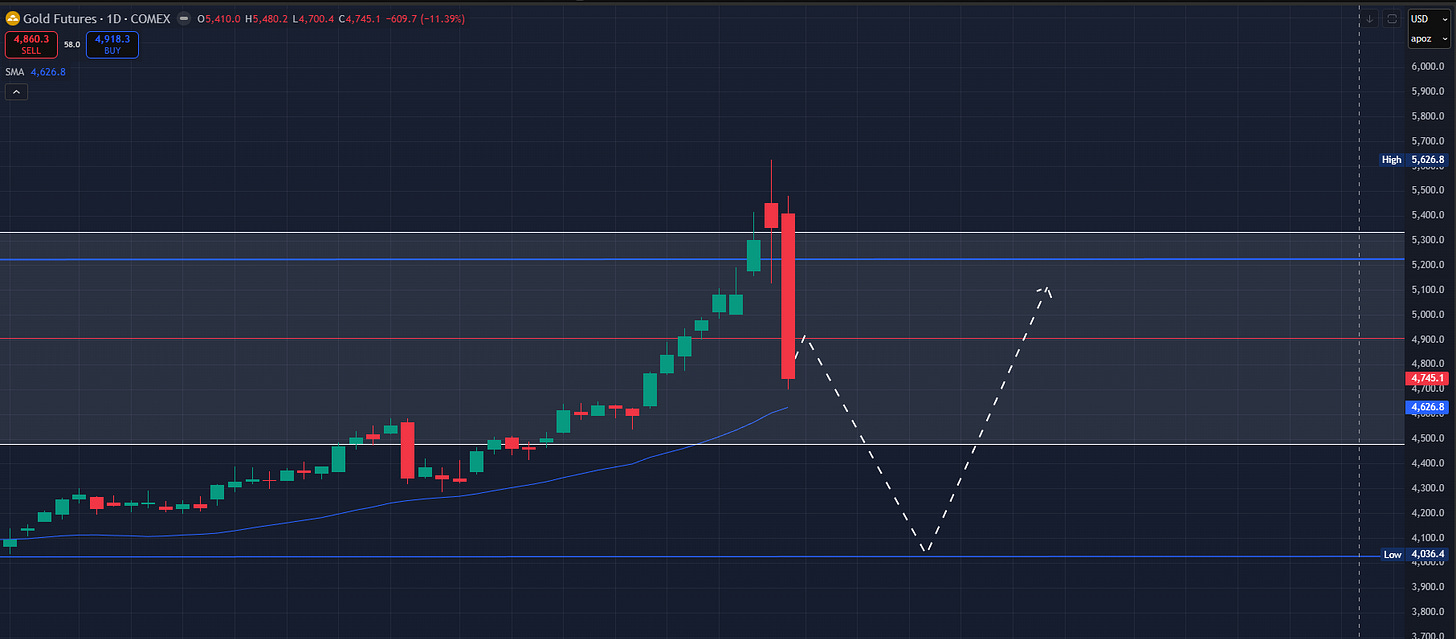

GC FUTURES

Weekly Expected Range: 5334 - 4480

Gold was very kind to us. We shorted at 5532 and banked significant profits. This was a “sigma event”—the kind that happens once or twice a lifetime—and I was happy to be invited to the party. With just 30% size (3 contracts), we raked in over $107k. I expect some bid on Monday to take us to the mid-range, followed by another downturn into February 11th. If you must go long, do it with equity; leave the futures to those with higher blood pressure.

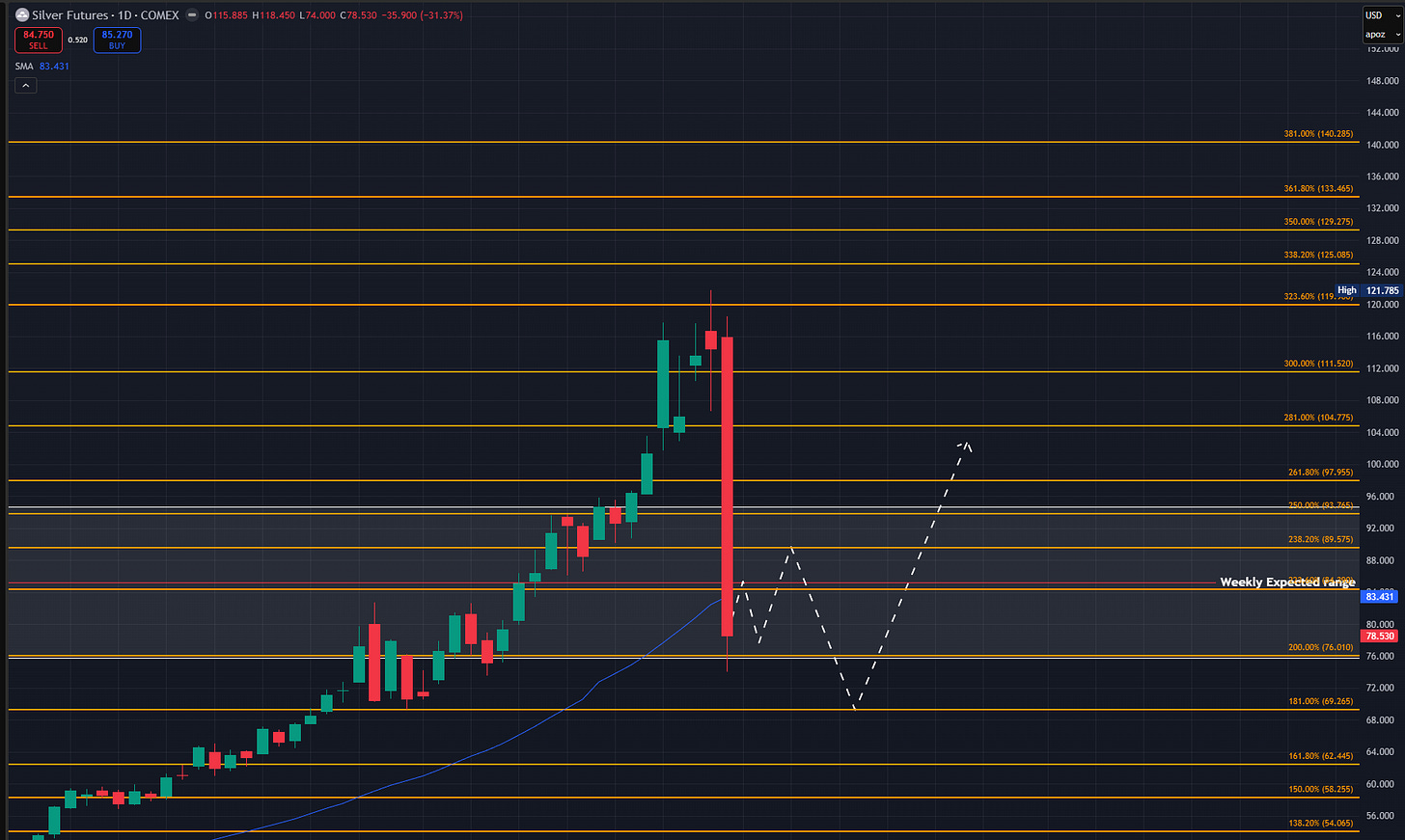

SI FUTURES

Weekly Expected Range: 94.68 - 75.8

Silver has collapsed, and Financial Twitter is, as usual, a cesspool of rumors ranging from JPM conspiracies to government manipulation. I am admittedly terrible at macro—every time I try to learn it, my life gets harder and my trading gets worse. The chart shows a rejection from one Fib level to another. Expect upside Monday, downside Tuesday, and a trap for the “dip buyers” that leads to a move lower into February 12th.

VX futures

Weekly Expected Range: 20.8 - 17.41

The algorithm suggests downside into Tuesday followed by upside into Thursday. This aligns perfectly with our equity views, assuming the math isn’t lying to us.

TLT

Weekly Expected Range: 88.18 - 86.08

I’ve been preaching the TLT long for a while, and we have a 25% position in calls. Expect strength into Tuesday, followed by a rejection toward the 86.5-87 range by February 9th. This should be the final bear trap before a breakout toward 89-90. I am very confident here; the bottom is essentially in.

ZB Futures:

Weekly Expected Range: 116.03 - 113.30

Bullish, similar to TLT. Upside into Tuesday, downside into the weekend. Again, this is likely the final bear trap before the real move starts.

CL:

Weekly Expected Range: 69.52 - 61.96

Our call options did a quick 130% recently because we are very good at this. However, I see a downtrend developing, likely signaling some “good news” on the geopolitical front. Downside into Wednesday, a brief pop Thursday, then a slow bleed toward 58.97 into February 18th.

USO:

Weekly Expected Range: 83.59 - 75.45

Oil is nearing a short-term top. A small bid Monday should lead to downside into Wednesday. After a brief Thursday bid, I expect consistent selling into the 20th.

NG:

Weekly Expected Range: 4.92 - 3.90

Natural Gas is currently a “nothing burger.” I’d like to see a rejection that fills the 3.2 gap by February 9th before looking for an entry.BTC:

After months of waiting, BTC finally tagged 76,372. I am long with 10% size and accumulating. Strong into Wednesday, down into Saturday. As long as 76k holds, we are looking at 89k by mid-February.

NVDA:

Weekly Expected Range: 199.4 - 182.86

The NVDA chart is finally talking to us again. Strength into mid-week, followed by a downtrend into February 20th. I’m looking for a move toward 171, or at least a false breakdown of 180, before I start loading up for earnings.

TSLA:

Weekly Expected Range: 449.08 - 411.74

We trimmed our earnings long because the options weren’t moving, which was the right call. Expect a bid to start the week, but I ultimately want to see a test of the lower channel edge around February 9th before getting back in.

AMD:

Weekly Expected Range: 250.94 - 222.52

I have waited months to short AMD, and the satisfaction is immense. Our puts are up 55%, and with earnings this week, I expect disappointment. Looking for a test of 214. No new trades; just letting the runners do their thing.

AMZN:

Weekly Expected Range: 249.15 - 229.45

This chart is currently uninspiring. Some weakness early week followed by a Wednesday recovery. I have a bearish bias for earnings but lacks enough conviction to play it. I’ll be watching from the sidelines with my popcorn.META:

Weekly Expected Range: 737.83 - 695.17

Last week was a masterclass in fading the crowd. While everyone and their mother was bearish, we rode the upside for 200-280% gains. For this week, strength into mid-week followed by a rejection toward 716. No trade here for me yet.

AAPL:

Weekly Expected Range: 266.15 - 252.81

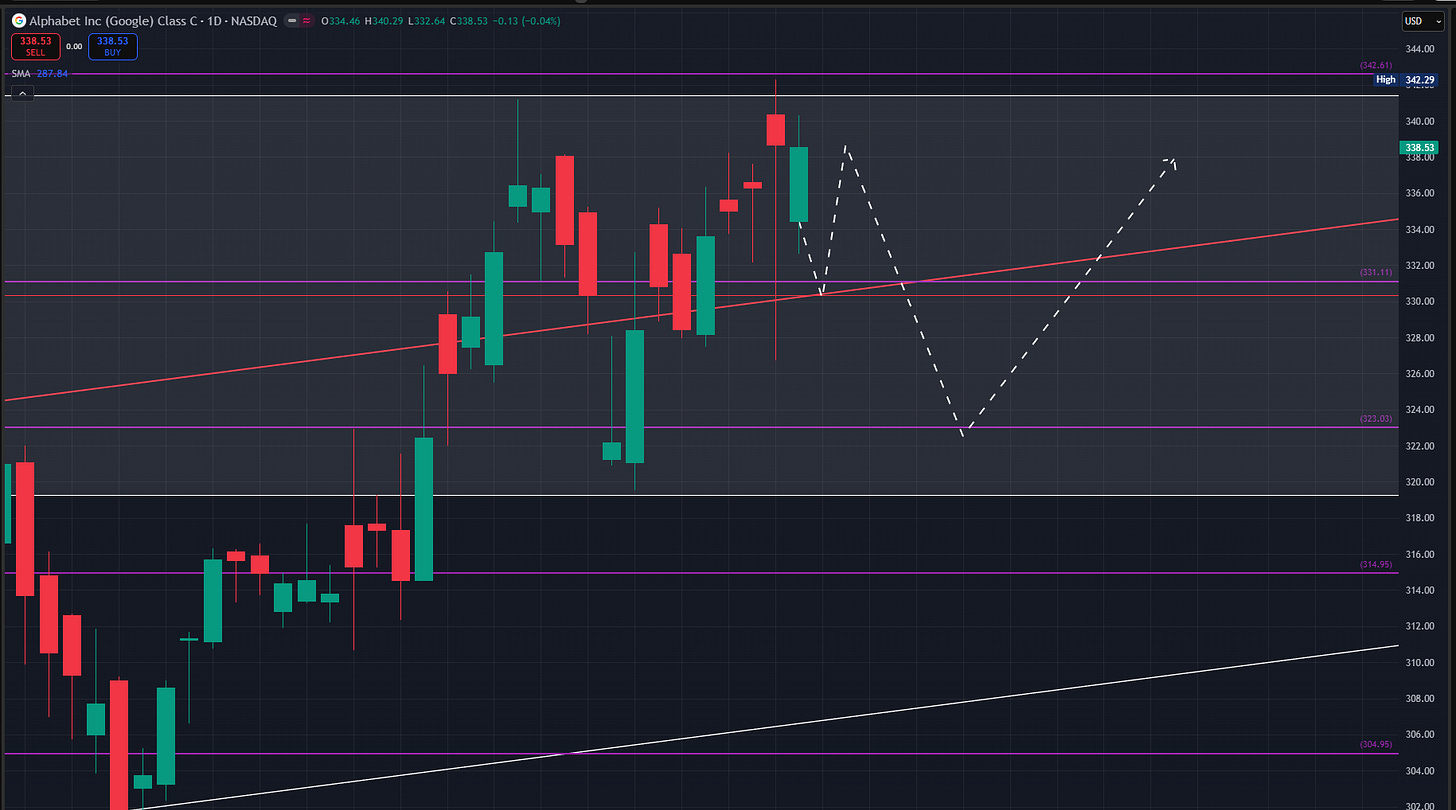

The structure was too ugly to play for earnings. Expect some early February upside followed by a sell-off toward 237 by mid-March. I’ve attached a long-term forecast for those who enjoy looking at lines far into the distance.GOOG:

Weekly Expected Range: 350.87 - 326.19

Still nothing worth the capital. Minor downside early week, recovery Wednesday, and then a trend down into February 10th. That is our next buy window.

MSFT:

Weekly Expected Range: 441.21 - 419.37

Despite the popular urge to go long into earnings, I insisted it would sell. Microsoft is the true “AI trade” bellwether, and it is currently broken. No rips are sustaining. Expect some dip buying into Wednesday, followed by a decent trend move down into February 11th.

AVGO:

Weekly Expected Range: 347.93 - 314.67

Broadcom is nearing a bottom. I expect sideways movement this week with a final low put in by February 10th. I’ll be looking for longs next week.

NFLX:

Weekly Expected Range: 86 - 80.98

Crucial week for Netflix. We must hold 82.8. If that level fails, we are looking at another 10% drop. We are long shares from 82.8; if the level breaks, I will take the loss and move on. There is no room for sentiment in a trade.

To trade is to participate in a version of Pascal’s Wager every single day. We wager our capital on the hope that the patterns we see are not merely hallucinations. The beauty of this approach is that we don’t need to be certain to be profitable; we only need to be positioned. If the market continues to reward our execution, we gain everything. If it doesn’t, we manage our risk and live to wager another day. Keep your stops tight and your hope grounded in the data.

Every trade has four outcomes, whether it is being taken by me, a black-box algorithm, a master hedge fund trader, or a degen living in his mother’s basement. Those outcomes are: the big win, the small win, the small loss, and the big loss. Success in this business isn’t about being a psychic; it is about elimination. As long as you can ensure you eliminate that fourth outcome: the big loss, you will inevitably make money over time. The math demands it. Do not give up when the tape gets messy; just ensure you’re still standing when the real moves begin.

Until next time,

Wicky

Thank you sir wick

Thank you Mr Wick, appreciate the hard work