Weekly Update: 02/07/2026

Beyond the Rational: Feeling the Rhythm of a Beautiful Trade

Show your support by liking and restacking this substack to continue free substacks and discord access. Your engagement = my motivation to keep cooking.

Good Morning

In life, a truly fulfilling existence is rarely something we simply stumble upon by chance or luck. It is a deliberate construction, a reality chosen and nurtured with patience over the course of many years. This process is not a cold, rational exercise of the head, but rather a pursuit driven by the heart; one that must be felt deeply to be understood. It requires an honest acknowledgement of what is actually worth the discomfort of growth, choosing the meaningful path over the easy one because the result is ultimately worth the struggle.

This same philosophy of intentional building applies directly to the art of trading. Just as a beautiful life is composed of the small, disciplined actions our future selves will look back on with gratitude, a successful portfolio is built through the accumulation of precise executions and the stamina to endure temporary discomfort. We do not rationalize our way into market mastery; we feel the rhythm of the tape and commit to a long-term plan even when the immediate environment feels uneasy.

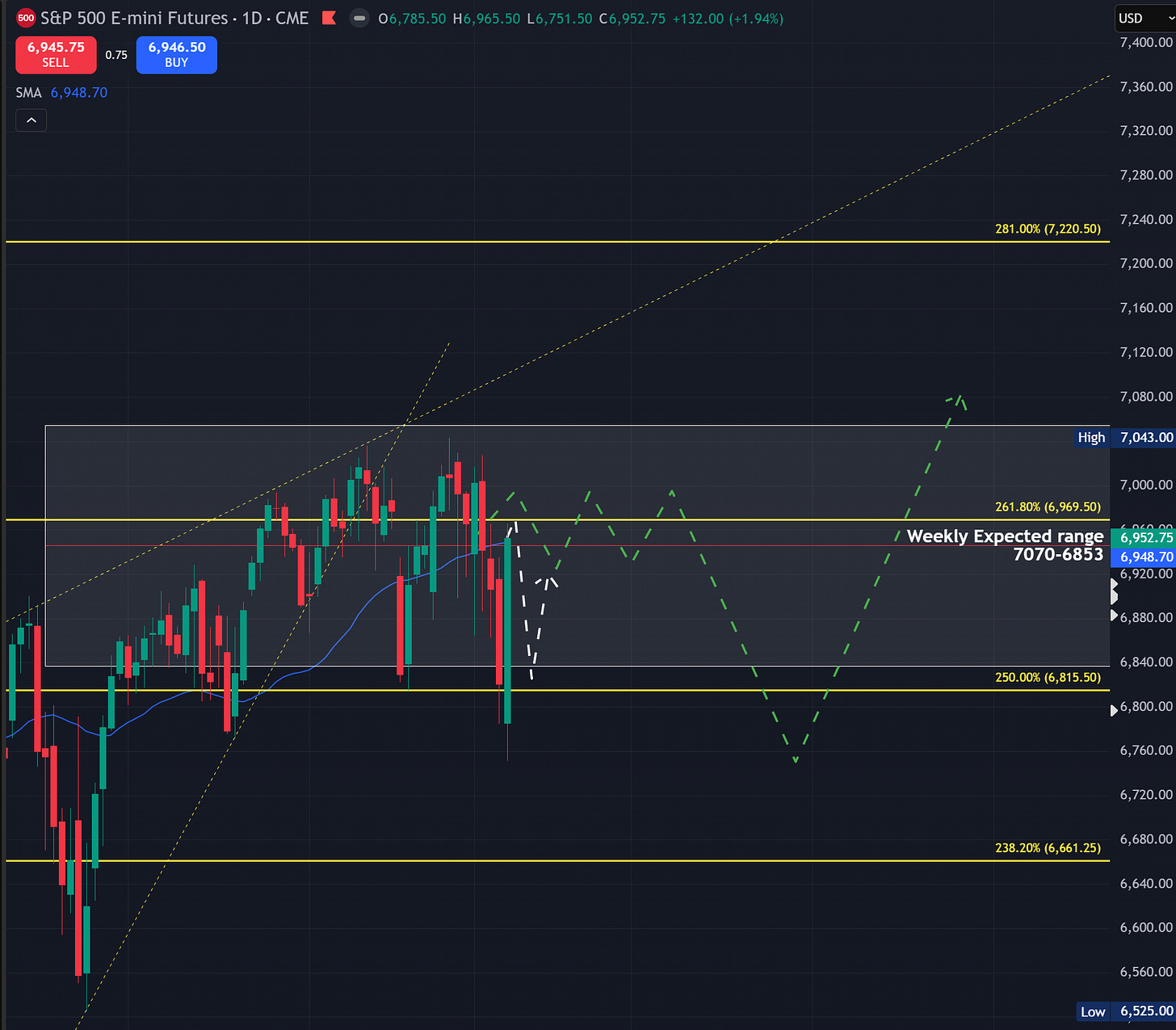

ES

Weekly Expected Range: 7054.53 - 6836.97

ES followed our plan last week with unmatched accuracy. As predicted, we marked the top on Tuesday and continued to sell into Thursday. Our bottom date was Thursday and the Friday target was 6920, and both turned out to be precise. Now coming to this week, as mentioned earlier, I would like to see one more bear trap to start this week. There is a possibility of a gap up; however, my analysis says that it will be faded into Tuesday or Wednesday again. Overall on a micro time frame, I would like to see downside early week into Tuesday end of day or the Wednesday early session. This downside will make retail think the Friday rally was just a fluke and turn the majority bearish again; from here, we will again start a pretty good rip into Friday, thus closing the week almost flat once more. On the chart, I have the monthly outlook and I expect us to be in this range overall into March 9th, which will again end up with a deeper dip into the end of March, post which we can start loading up some long-term longs.

NQ

Weekly Expected Range: 25644 - 24571

Our NQ analysis from last week was precisely accurate as well. This week, I am looking at a very long-term monthly path. Overall on a micro time frame, for this week, I see downside developing into Wednesday as a big bear trap. Post Wednesday mid-session, I anticipate the market to be strong into Friday, followed by a slight dip into OPEX, which will again turn out to be a trap and help NQ to be strong and to the upside into at least February 20th.

RTY

Weekly Expected Range: 2731 - 2616

RTY again followed our laid-out path exactly, and as expected, we had a massive rip to close out the week. For this week, I would like to see a small dip on RTY to start the week. I anticipate that we will have a risk-off tape to start the week into Tuesday; however, post Tuesday, you should look for a false breakdown of 2654. After that, we will start another upside move towards the all-time high around the 2430ish level.

SPY

Weekly Expected Range: 702.07 - 679.17

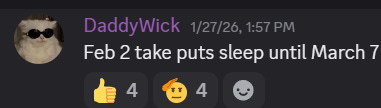

As expected, SPY tested sub 680 last week, and this move was given to you by me months in advance. Many people called me names for this analysis, but I remember clearly begging everyone not to short before February and then to go short on February 1. On January 27th, I mentioned in our discord that:

Now if you listened and played with even hedges, you would be very green and happy, but if you did not, the markets are always there and there is always a next trade. Now coming to this week, I would like to see a risk-off setup early in the week, followed by a rip into late week which will again have us end the week almost flat. I would like to see downside into Wednesday, followed by a bottom and a rip into Friday.

SPX

Weekly Expected Range: 7044.04 - 6820.56

SPX again followed our plan. For this week, I am looking for a downturn early in the week, basically employing the same playbook as last week. Sell the Monday high, cover into Wednesday, add longs Wednesday to Thursday end of day, and cover in profit by Friday. The market is still in a range and I anticipate it to be ranged into March. Overall, I think the majority of near-term downside is behind us and this early week will mark a bear trap followed by a violent squeeze into February 20th, which will be another bull trap at the highs.

QQQ

Weekly Expected Range: 623.29 - 596.01

QQQ followed our plan again last week with extreme accuracy. Coming to this week, on a micro time frame, I would expect us to either mark a high in globex or the Monday session, though there is a very high probability we marked this during the Friday last 10 minutes rip. Overall, I am looking for a sell into Wednesday for a double bottom trade. From here, we will load longs for the month end and I anticipate we will have a decent-sized rip right into Friday. Post Friday, I would like to see another small dip into next Tuesday which will ultimately resolve to the upside by February 20th.

GC FUTURES

Weekly Expected Range: 5127 - 4850

GC futures have a pretty tight predicted range, and I anticipate this is due to a contract switch; hence, I am focusing on the structure. For this week, the bias is pretty clear: we want to see downside on Monday followed by a swift recovery on Tuesday. This swift recovery will lead to a pretty good drop into Thursday, and this drop will turn into a massive bear trap. Like I have said before, 2026 in terms of market structure is a year of gaslighting. Whenever you are certain a setup has finally given you confirmation, the market will reverse with force, giving you no time to adjust unless you are already prepared and nimble. On a weekly time frame, GC is a sell-all-rips for me until the week of March 2. Post March 2, we will have an early month rip into the week of March 9th, which will again be sold ferociously into the end of March.

GLD

Weekly Expected Range: 469.49 - 441.43

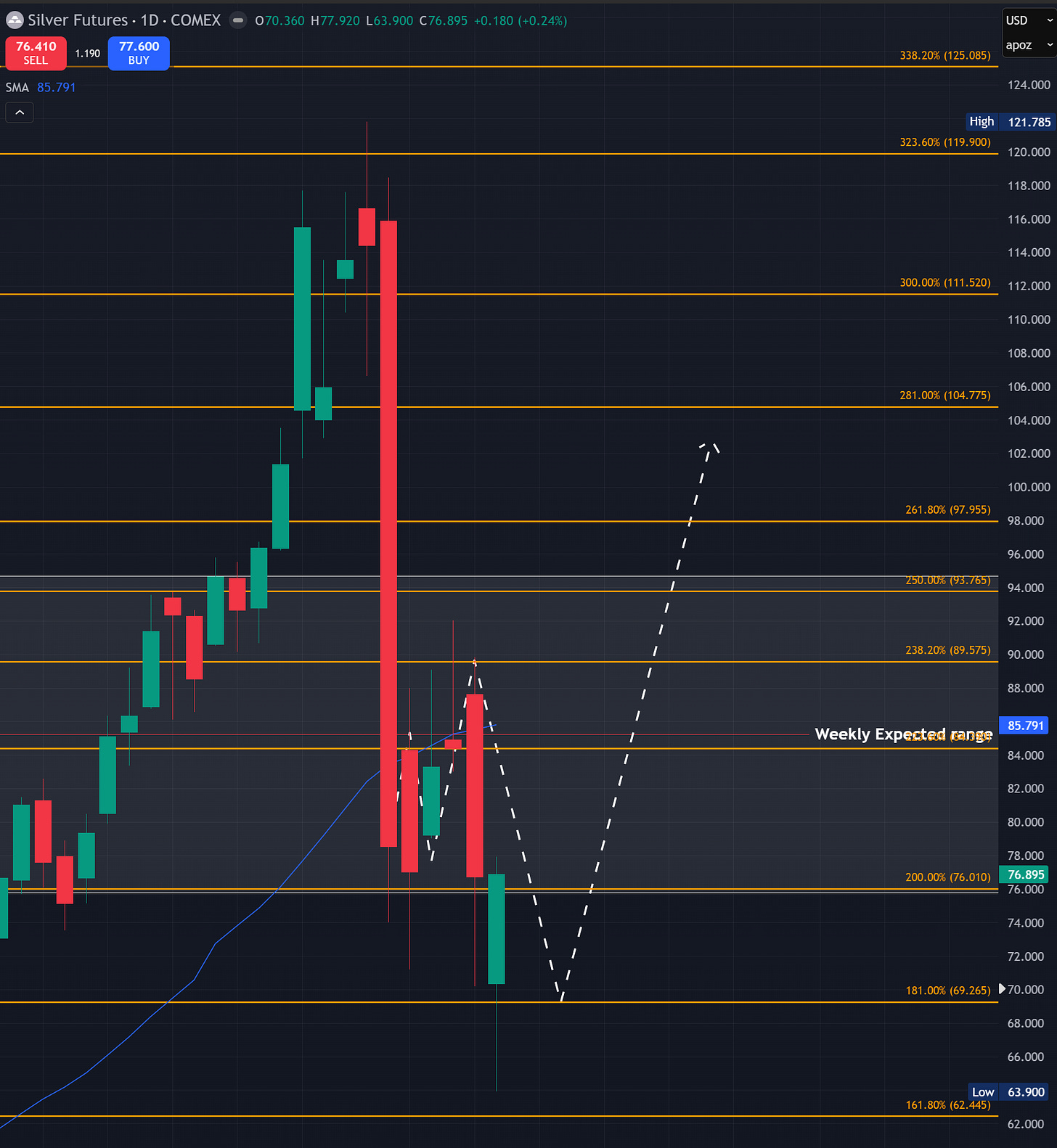

SI FUTURES

Weekly Expected Range: 84.67 - 70.97

SI has followed our laid-out path pretty accurately, hence I am not changing any predictions. On a micro time frame, I see SI under pressure and downside into Monday, followed by a small rip into Tuesday. I think this rip will be a bull trap and we will sell again into Thursday to make a lower low. This low will prove to be a bear trap, and a test of the 62.4ish level will start a pretty good squeeze up into at least February 25th.

VX futures

Weekly Expected Range: 20.52 - 17.76

For VX, I would like to see slight downside into Monday followed by upside into Wednesday. Post Wednesday, I think we will see VX selling again into the 17.87 level.

TLT

Weekly Expected Range: 88.53 - 86.55

TLT has been following our long-term plan almost perfectly. Despite majority and known names on social media being bearish on bonds, we have been accumulating dips and the plan is coming to fruition. For this week on a micro time frame, I would like to see downside into Monday, followed by a small rip on Tuesday. I think this rip gets sold to create a final bear trap into February 11th. Post this, I am expecting TLT to test at least 88.94 by February 20th.

ZB Futures:

Weekly Expected Range: 116.12 - 114.19

ZB has been tracking pretty well, and I think this week we will likely see an early week dip which will be bought with both hands. My expectation is for bullishness and dip buying to continue at least into February 20th, followed by another downturn.

CL:

Weekly Expected Range: 66.58 - 60.42

There is no change in expectations on CL. Our last week’s analysis played out perfectly and this week, I would expect more pain for CL into at least Tuesday. Post Tuesday, we will likely see some recovery on Wednesday; however, this will again be sold into the end of the week. Overall, my bias is that we will see 59.99 soon enough.

USO:

Weekly Expected Range: 80.71 - 73.27

For USO, there is again no change in analysis from last week. Downside should continue into at least February 14th.

NG:

Weekly Expected Range: 3.715 - 3.095

NG followed our downside and rip analysis last week perfectly. For this week, I am seeing another long opportunity. Basically, I would like to see downside into Monday end of day or Tuesday, followed by a pretty good upside move into February 17th. I will be looking to take this trade.

UNG:

Weekly Expected Range: 14.3 - 12.24

BTC:

BTC followed our downside which we have been waiting for months, albeit it went to the next level instead of holding at 76k. For this week, I am pretty bullish on BTC and anticipate that we continue towards the upside into February 11th. Post this, we should see a small dump into February 12th, followed by a pretty good squeeze into February 15th, where the next fade likely begins.

NVDA:

Weekly Expected Range: 194.2 - 176.62

As expected, NVDA followed our plan last week and stopped right at the 171.7 level. From here, it started a rip towards 185, which also happens to be the 200-day SMA. For this week, I would like to see downside on NVDA into pretty much the entire week, into Thursday, and a weak bounce on Friday. This downside will turn into a bear trap as NVDA will start to bounce aggressively post this week into February 20th.

TSLA:

Weekly Expected Range: 428.98 - 393.24

TSLA has likely put a short-term bottom around the 387 area. For this week, I would like to see upside into Tuesday, followed by a quick reject into Wednesday. I think this reject will be bought up again into the end of the week with a slight chance of downside on Friday. Overall, I see this week as accumulation for TSLA and anticipate that this bull run will take TSLA to at least 438.75.

AMD:

Weekly Expected Range: 219.63 - 197.25

Last week I noted that I waited very patiently to short AMD, and the market rewarded us as expected with a dump to 190 on earnings. We closed our puts at close to 130% and gave thanks. For this week, I would like to see some upside in AMD into Tuesday, followed by a quick reject into Thursday which will again be bought up into Friday. I think AMD is a good short-term buy here.

AMZN:

Weekly Expected Range: 217.2 - 203.44

As posted last week, AMZN marked the high on Tuesday and kept dumping. On the day of earnings, I chose not to play AMZN since I saw a dump, yet simultaneously saw a major squeeze on ES which eventually ran from 6750 to 6960. For this week on AMZN, I think we are about to see some downside again, probably towards the lower 200s; however, I am seeing a pretty epic squeeze from here into the end of February and I will be taking this position via equity as early as Tuesday.

META:

Weekly Expected Range: 682.99 - 639.93

META has been excellent for us. We closed META calls on earnings for a 200%+ gain, and post-earnings it even followed our downside path. Overall for this week, I think we are about to see another mega squeeze on META soon and I would like to position myself with equity or options. I expect consistent downside pressure on META into mid-week, probably Wednesday or Thursday, post which we are about to see a mega squeeze for META at least into March 6th.

AAPL:

Weekly Expected Range: 294.93 - 271.31

There has been no change in our analysis for AAPL. While I see a pretty decent short setup here, I am hesitant to short it. Overall, I would like to see consistent downside on AAPL and this risk-off move should continue very well into the end of February.

GOOG:

Weekly Expected Range: 333.66 - 312.54

GOOG once again followed our thesis and as expected the earnings move was mostly an IV crush. I am expecting some more downside on GOOG this week towards 315, followed by upside into the end of the week. Overall on a micro timeframe, I would like to see downside into Tuesday followed by upside into Friday. Post this we will likely see one more downside next week, but that will just be a spring reaction and GOOG should have a great snap-back rally towards the 331–342 range.

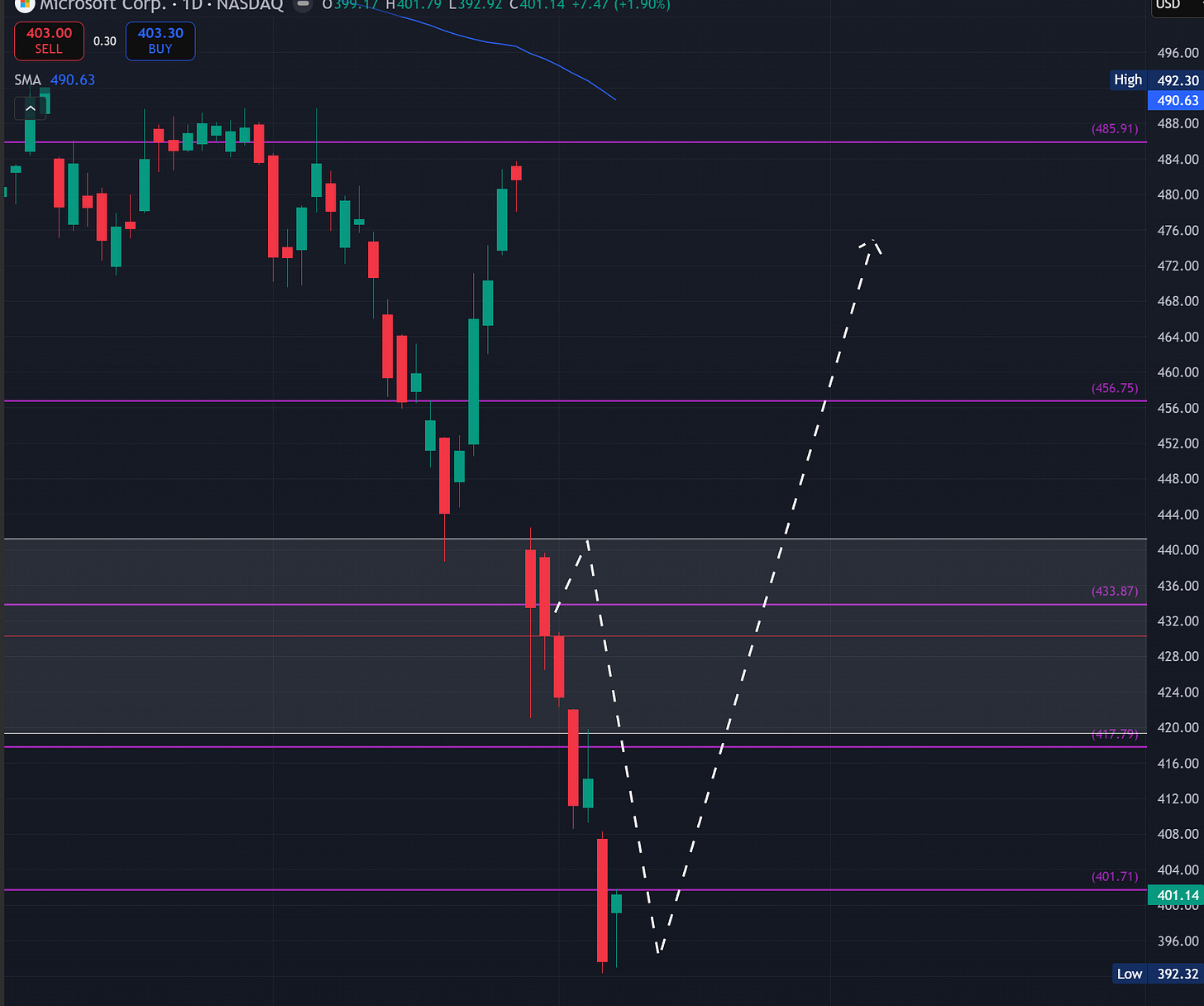

MSFT:

Weekly Expected Range: 412.21 - 390.07

We nailed the MSFT dump. For this week, I expect some more bleeding into Wednesday, followed by a pretty good start of a rip. This rip should continue the upside at least into the March 4th to March 9th window.

AVGO:

Weekly Expected Range: 351.22 - 314.62

I would like to see some selling on AVGO into February 17th. However, this does not mean shorting. This selling can form into a sideways pattern; however, there are no trades for me on this ticker until February 16th or 17th.

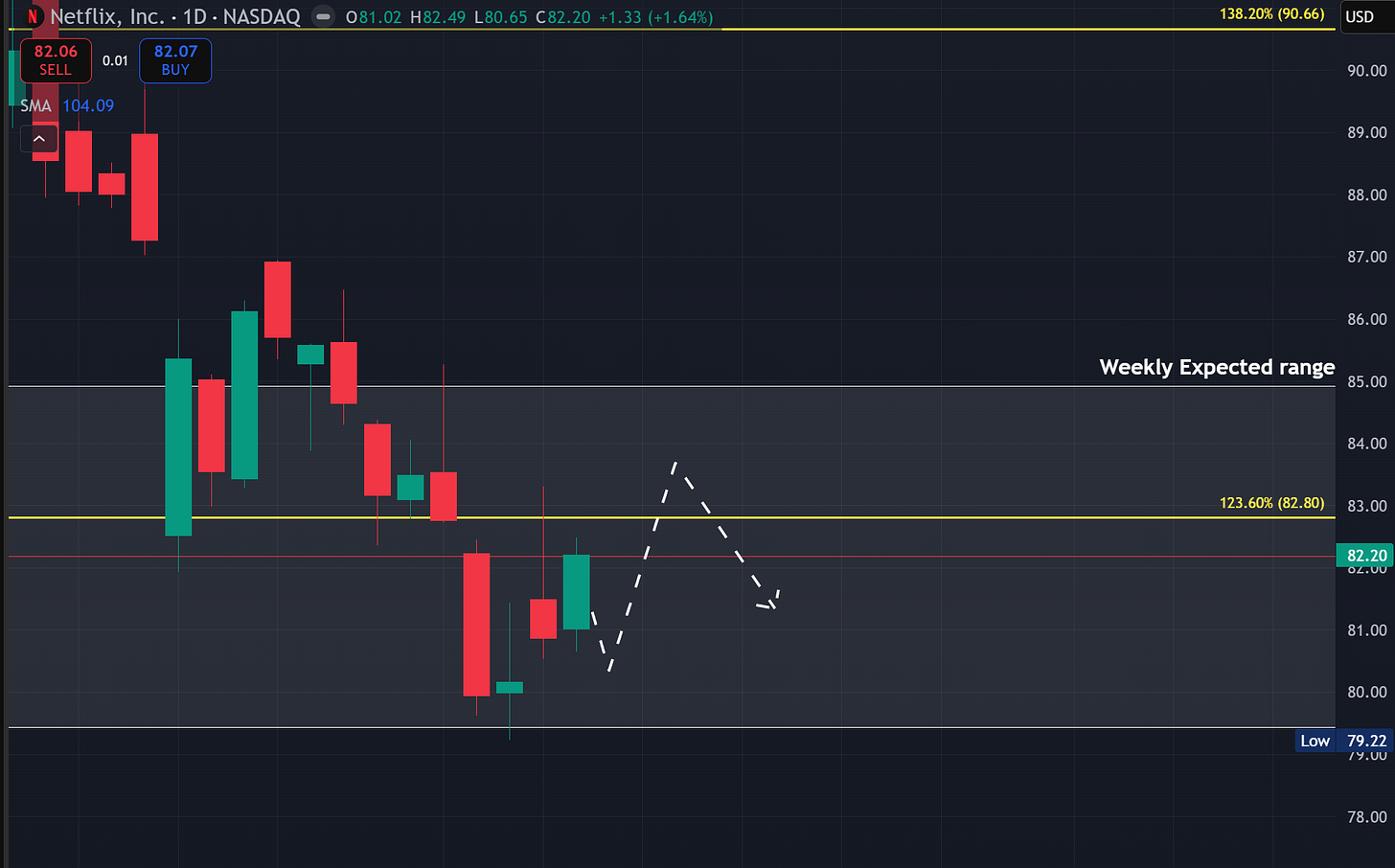

NFLX:

Weekly Expected Range: 84.92 - 79.48

We are still in the NFLX equity position and I think our good exit will come on March 5th. Overall for this week, I would like to see some early week downside followed by upside into Thursday. I see another sell developing, so expect to be sideways for this week as well.

Building a successful trading career, much like building a meaningful life, requires the heart to endure those moments of high-tension “gaslighting” where the market seeks to shake your conviction. We must be willing to sit through the early-week downturns and bear traps, acknowledging that the temporary discomfort of a retracement is simply part of the structure required for a violent squeeze.

The years of observation we put into these tickers allow us to remain nimble and prepared when the crowd turns bearish at the wrong time. Risk management is the ultimate prayer of the disciplined trader; a whispered commitment to surviving the noise so we can thrive in the expansion.

Stay focused on the levels and the dates, and remember that the best setups are nurtured by those who wait for the trap to spring.

Until next time,

Wicky

Grazie Man

Thank you!!!