Weekly Update 02/16/2025

Charts, Candles, and Chaos: Navigating the Market Like a Sleep-Deprived Fortune Teller on Their 5th Cup of Coffee

Happy Sunday, my fellow candle chasers! If you followed last week's update, you probably had a fantastic trading week—or at least managed to avoid making a donation to the market gods. Despite CPI and PPI trying their best to ruin the fun, we absolutely nailed our swings and day trades like a seasoned chef flipping pancakes. It was, dare I say, one of the best weeks so far.

But let’s not get ahead of ourselves—trading isn’t all rainbows and moon landings. As I collapsed into bed Friday night, exhausted but victorious, I had a moment of enlightenment: “How lucky I am to fall into bed exhausted.” Because let’s be real—markets can humble you faster than a rogue wave takes down a beginner surfer. Money is just a tool, an instrument, a mere mortal’s attempt to surf the tides of financial chaos. So let’s remember: trade hard, but keep your soul intact.

SPY: A Love-Hate Relationship with 609

SPY 0.00%↑ looking like that ex who keeps texting, but never commits. We need strength on Tuesday, likely marking a short-term high pivot. Futures will probably do some holiday trading nonsense, but cash session SPY should reject and start a downturn into Wednesday/Thursday—only to bounce again like a stubborn rubber band into next Monday.

The 609 level? Legendary. It’s like the bouncer at the club who lets you in but never actually lets you party. We’ve closed above it once, but until we do it twice in a row, it’s just a fake-out. If we reclaim it, though? That’s when the bullish momentum kicks in. This market isn’t for the weak—it’s for risk-takers, thrill-seekers, and people who laugh in the face of logical investing. This is the year of extremes. Buy the extremes, sell the extremes, and ride the rollercoaster.

NVDA: Soros Would Be Proud

NVDA 0.00%↑ Last week, I said we should see 128-130 midweek as a buying zone, and boom—NVDA closed at 138.85. Am I convinced to short yet? Nope. Not yet. Remember the great George Soros? “When I see a bubble forming, I rush in to buy, adding fuel to the fire.” Now, I’m not saying we’re financial wizards like him, but we can definitely play the game and light a few matches.

Plan for this week: Upside into Wednesday/Thursday, target 140.76, and then a false breakout leading to a downturn next Monday/Tuesday.

AMD: The Prodigal Son Returns?

AMD 0.00%↑ I took a little break from AMD because, honestly, it’s been acting like a moody teenager. Any spike was short-lived, as predicted. This week, I want to see some early weakness before it finds a tiny, adorable bottom midweek. Nothing major, no grand setups—just playing level to level like an indecisive online shopper who fills their cart but never checks out.

TSLA: 🚀 or 🚗?

TSLA 0.00%↑ Last week, I called for 325-329 buys, and we got in at 326ish before blasting to 360 like an over-caffeinated rocket. This week? I see a strong open Tuesday, a dip Wednesday (Feb 19), and continued momentum into next week. Unless 347.58 breaks again, I’m bullish. Above that, next stops: 365, 387, and 414. TSLA’s basically doing a sprint relay—except it keeps dropping the baton and picking it up just in time.

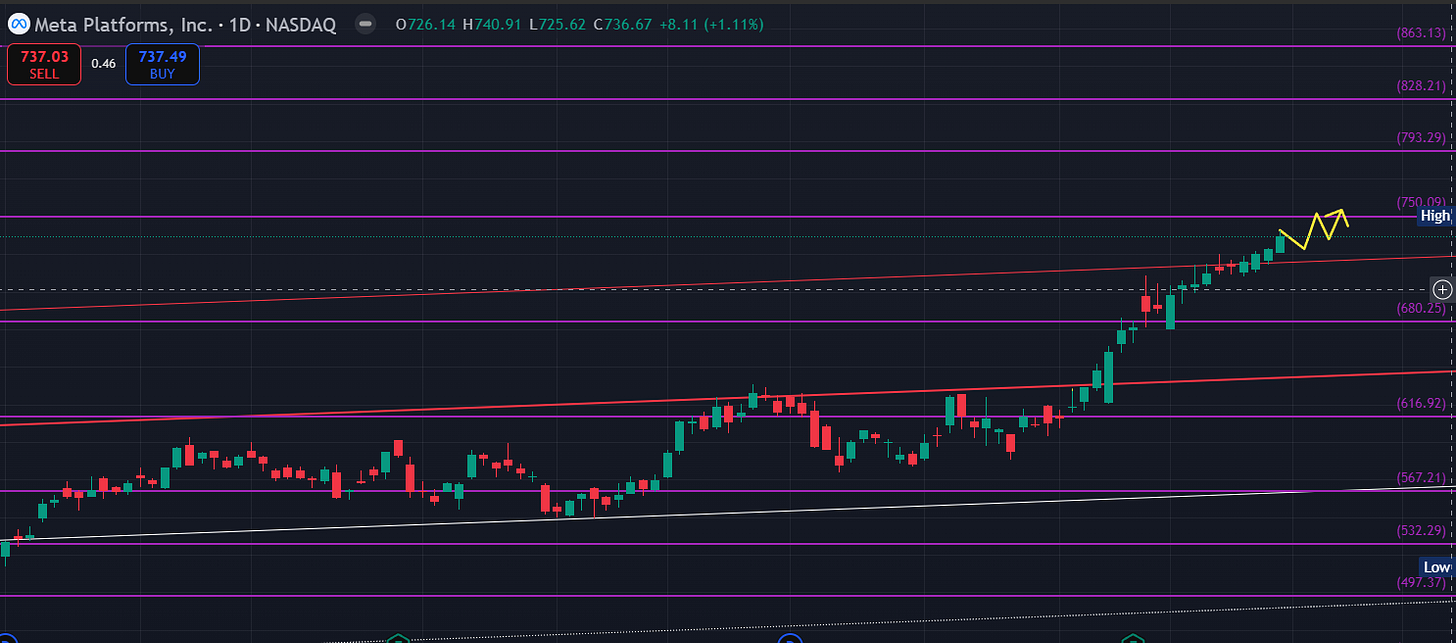

META: The Overconfident Athlete

META 0.00%↑ Last week, I refused to short until we broke 695—and that saved us from faceplanting into a premature short. Now, we’re looking at 750 and 793.29 as key levels. Expect midweek weakness followed by chop city.

Want a short? Wait for a daily close below 725. That’s your cue to aim for 680. Until then, I’m watching from the sidelines like a coach who doesn’t trust their team’s defense.

AMZN: The Sneaky Setup

AMZN 0.00%↑ If you caught Friday’s live session, I literally told you AMZN was setting up for another rally. And guess what? It closed at the critical 228.76 level. This week, I want to see a fake breakdown, a low into Wednesday, and then a rally back up.

The play? March-end/April-mid 240c. If 228.76 gets reclaimed, that’s your go signal. If not, well… pretend you never read this.

AAPL: The Stubborn Mule of Tech Stocks

AAPL 0.00%↑ bounced right off our 228.56 level and started a solid rally. This week? Strong Tuesday, then choppy downside into Friday. Not super keen on playing it, but if we get that downturn into Friday, I’ll grab some month-out calls for a snapback rally.

As long as 241 holds, we should see 254.72 eventually. Think of it like a stubborn old man—it won’t move unless it absolutely has to.

GOOG: Finding a Bottom (No, Not That Kind)

GOOG 0.00%↑ We predicted the earnings move weeks ago, calling for a 205 rejection down to 192-194—and here we are. 186.09 has been reclaimed, and I see a small test of support into Wednesday. That’s your signal to go long with month-out calls for a move to 194.17.

It’s not a rocket ship, but it’s at least a sturdy bicycle ride uphill.

MSFT: In No Man’s Land

MSFT 0.00%↑ Still waiting for 401-404 to go long. Until then, no trade. Expect some early week weakness, but it should get bought quickly.

Right now, MSFT is like a hesitant poker player waiting for the right hand. Levels of interest: 401.71 and 417.79. Look for fake breakdowns/breakouts and react accordingly.

Alright, that was your weekly dose of market chaos. I know, I know—trendlines, levels, candles, indicators, blah blah blah… Sounds like I have everything figured out, right? Well, let’s be clear—I am just a cat in sunglasses, lounging in the heat of red candles and seeking the sweet shade of green ones.

This is not financial advice. This is financial improv.

Until next time—Arrivederci, my degenerate friends. 🚀🐈⬛🔥

Amazing Sunday afternoon read preparing for a great week with the great wicky

“Great breakdown of the major stocks in the market. Your insights into the current trends and potential future movements really put things into perspective. I especially appreciated how you highlighted the balance between short-term volatility and long-term growth potential across these companies. Thanks Goat 💖🐐