Weekly Update 11/22/2025

The Signal You Can’t Ignore: Markets Closing Outside Their Weekly Bounds

Before diving into the charts, I want to highlight something extremely important. For the first time in a while, equities have closed under their weekly expected range at the same time that volatility has closed above its weekly expected range. This combination almost never happens by accident. Whenever we have seen this historically, the following week has almost always produced a deeper move in the same direction. Equities closing beneath their range is forced selling by big players, and VIX closing above its range is forced hedging. That is not a setup for complacency. Anyone who thinks this is an automatic dip buy environment needs to be careful.

This is also a short trading week, which means liquidity will thin out, price action will slow down, and once direction is chosen early week, markets tend to drift that way for days. Chop is absolutely possible, but usually in a compressed and inefficient form. The broad takeaway: stay light, stay patient, and do not let a single green candle fool you into assuming the worst is over.

ES

Weekly expected range: 6763 - 6499

Last week we called ES almost perfectly from start to finish. The drop, the bounce into the midpoint of the expected range, the rejection, the recovery. All clean. What matters now is that ES closed beneath the weekly expected range. This is exactly the scenario I warn about constantly because these ranges are not arbitrary numbers. They are derived from dealer hedging flows, volatility pricing, and option models that reflect institutional pressure. A close under the lower boundary means big players are still being forced to sell.

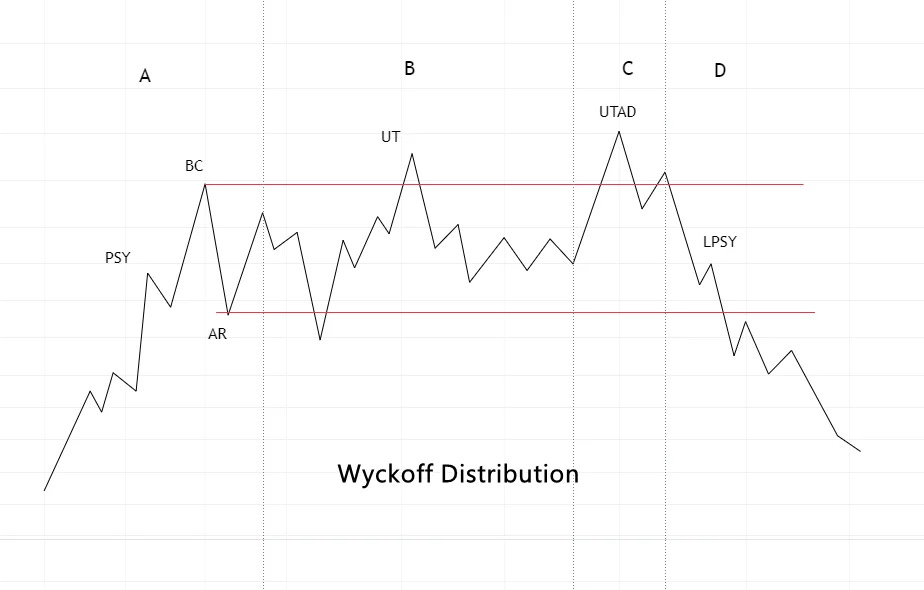

For this week I expect weakness on Monday and Tuesday. After that, I am looking for a bounce that carries into Friday, but the bounce is not indicative of strength. It is simply the upper leg of a larger distribution phase. If you pull up the daily, we are forming a classic distribution structure and these patterns often complete with a sharp return toward the highs that ultimately becomes a short setup, not a long.

Possible trades

- Short entries around 6670 to 6695 with stops in the 6725 area targeting 6555 then 6505.

- Long entries only if 6500 to 6530 reclaims with strength, targeting 6620 then 6680.

NQ

Weekly expected range: 24985 - 23713

I want early week weakness here as well. Monday should be red, Tuesday should give a bounce, and Wednesday likely brings a shallow pullback. That pullback, if controlled, is a buy into Friday. But keep in mind we are in bearish structure, so any upside trades should be smaller in size until we clear the December 3 to 4 window. After that, I still expect a stronger move to the upside into year end.

Possible trades

- Long near 23850 to 24000 on reclaim with stops under 23700 targeting 24550 then 24900.

- Short near 24800 to 24950 targeting 24200 then 23850.

RTY

Weekly expected range: 2436.6 - 2320.2

Monday should give weakness, ideally tagging the 2285 level or giving a false breakdown under it. From that zone I expect a move toward the 2385 to 2415 range into the end of the week. The Russell is still a structurally weak index, but this week looks like a controlled bottoming attempt.

Possible trades

- Long 2285 to 2310 with stops under 2265 targeting 2370 then 2410.

- Short 2410 to 2430 targeting 2340.

YM

Weekly expected range: 47090 - 45664

YM should show downside pressure into Tuesday and then begin a slow rally into Friday. Nothing explosive, just a gradual grind higher if Monday and Tuesday flush properly.

Possible trades

- Long 45900 to 46200 with stops under 45600 targeting 46900 then 47400.

- Short 47400 to 47600 only if Wednesday pullback fails to make a higher low.

SPY

Weekly expected range: 673.44 - 644.62

SPY follows the same rhythm as ES. I want downside Monday, upside Tuesday, a controlled washout Wednesday, then slow upward drift into Friday. As long as Wednesday’s pullback does not break Monday’s low, this structure holds.

Possible trades

- Short 666 to 670 targeting 652 then 646.

- Long 646 to 651 reclaim targeting 663 then 669.

SPX

Weekly expected range: 6742 - 6463

SPX sits dangerously close to the 6470 level, which I expect gets tagged early this week. Monday likely hits it, Tuesday brings a bounce, Wednesday offers a shallow pullback, and Friday finishes upward if the Wednesday low holds.

Possible trades

- Long 6470 to 6500 with stops under 6430 targeting 6610 then 6680.

- Short 6650 to 6690 targeting 6500.

QQQ

Weekly expected range: 606.2 - 573.94

Downside early week, ideally into the 573–578 range. From there, a slow grind upward into Friday. There is a minor chance of a Wednesday pullback, but as long as it stays shallow, the end-of-week continuation stands.

Possible trades

- Long 574 to 580 with stops under 570 targeting 596 then 604.

- Short 602 to 606 targeting 585.

GC FUTURES

I still want GC to tag the 3855 support and I see no reason to change that. This week should be consistent selling into Wednesday with a small recovery afterward. Anyone trying to long GC early is ignoring the fact that the macro structure still supports a lower high breakdown which hasn’t played out yet.

Possible trades

- Short 4020 to 4060 targeting 3920 then 3860.

- Long only on 3855 reclaim with targets toward 3990.

TLT

Weekly expected range: 90.59 - 88.41

TLT should explore lower prices into Tuesday and then move back toward the upper edge of the range around 90.5 into Friday. Bonds are in a slow transition phase here, not a quick trend.

Possible trades

- Long 88.50 to 89.00 with stops under 87.80 targeting 90.40 then 91.20.

- Short 91.00 to 91.30 targeting 89.50.

ZB Futures:

Weekly expected range: 117.24 - 116.21

ZB should continue its downside into Wednesday followed by a small recovery into Friday. Nothing particularly exciting here yet.

Possible trades

- Long 116.10 to 116.20 targeting 117.00.

- Short 117.00 to 117.25 targeting 116.20.

VX Futures

Weekly expected range: 23.37 - 19.63

VIX closed above the upper bound of last week’s expected range, which is exactly the type of close that signals continuation in the same direction. I expect another volatility spike toward the upper edge of the range early this week and then a slow bleed into Friday. This lines up perfectly with the equity roadmap described above.

NVDA:

Weekly expected range: 188.08 - 169.68

Our read on NVDA earnings played out exactly right. The algorithm pointed to a rip but the structure pointed to a selloff, and the selloff won. Now for this week I expect downside Monday, ideally a false break of the 171.7 level, then a move toward the 176–178 range. NVDA remains buyable only if 180 continues to hold.

Possible trades

- Long 170 to 173 on reversal with stops under 168 targeting 178 then 184.

- Short 184 to 187 targeting 176.

TSLA:

Weekly expected range: 413.8 - 368.38

TSLA continues to show no signs of risk-on behavior. This week should be weakness into Tuesday, small recovery into Friday, but still within a bearish longer-term structure.

Possible trades

- Long 370 to 380 on reversal targeting 395 then 410.

- Short 410 to 414 targeting 385.

AMD:

Weekly expected range: 216.03 - 191.53

AMD is still dealing with the gap below and I still expect it to fill eventually. This week should show weakness Monday, a short-lived Tuesday rally, selling into Thursday, and then a small relief bounce Friday.

Possible trades

- Short 210 to 214 targeting 199 then 193.

- Long 193 to 196 on reclaim targeting 205.

AMZN:

Weekly expected range: 228.37 - 213.01

Amazon is setting up a very solid bullish swing. I want weakness early week and ideally a test near 213. From that zone, I want to see a bounce toward 228.75 and likely continuation afterward. Early-week dip buys should offer strong risk-reward.

Possible trades

- Long 213 to 216 with stops under 210 targeting 225 then 229.

- Short 229 to 231 targeting 220.

META:

Weekly expected range: 614.53 - 573.94

META remains a longer-term buy in my book. The analysis here is focused on the larger picture, not the weekly chop. I plan to add early this week and bring my swing to half-size. Short-term volatility is irrelevant to the broader multi-month view.

Possible trades

- Long 575 to 585 with stops under 568 targeting 610 then 635.

AAPL:

Weekly expected range: 287.31 - 264.67

AAPL continues to hold up better than the rest of the market. I expect early-week weakness followed by buyers stepping back in for the end of the week. It should remain in the same range.

Possible trades

- Long 265 to 270 with stops under 262 targeting 279 then 284.

- Short 284 to 287 targeting 274.

GOOG:

Weekly expected range: 310.33 - 288.97

GOOG rejected perfectly from 304.95. I expect a sweep of the 288 level and then a move back toward 300. If the sweep happens with a strong reclaim, it becomes one of the cleaner longs of the week.

Possible trades

- Long 288 to 292 reclaim targeting 300 to 304.

- Short 304 to 308 targeting 294.

MSFT:

Weekly expected range: 484.74 - 459.5

My stance remains the same: all rips on Microsoft during the second half of 2025 have been sells, and that view continues to pay. This week I expect a test near 458, followed by a twenty to thirty point rip into the 480–485 zone, which sets up a short-term long swing, not a long-term reversal.

Possible trades

- Long 458 to 462 targeting 478 then 485.

- Short 485 to 488 targeting 470.

NFLX:

Weekly expected range: 107.76 - 100.86

NFLX should trend lower into Wednesday, then see a small recovery into Friday. I am not taking trades here yet until structure cleans up.

Possible trades

- Long 101 to 103 for a scalp into 108 then 112.

This is a week where traders need to respect the fact that equities closed under their weekly expected ranges while volatility closed above theirs. That combination reflects forced selling, forced hedging, and structural pressure that does not unwind in a single day. Add to that a short week with thinner liquidity, and you get a scenario where the first move of the week often dictates the entire directional drift.

Trade smaller, trade cleaner, and avoid treating any bounce as confirmation that the worst is over. The deeper move may still be underway, and until the levels prove otherwise, caution is not optional.

As always, this is not financial advice. This is financial improv, and the market will reward the ones who stay disciplined, not the ones who chase noise.

Until next time,

Wicky

🐐

Thank you Wick.