Weekly Update 12/28/2025

Show your support by liking and restacking this substack to continue free substacks and discord access. Your engagement = my motivation to keep cooking.

Good Morning.

As 2025 quietly winds down, this is one of those rare stretches on the calendar where the market slows just enough to remind us that not every week needs to be traded like a main event. With only a few holidays left on the board, this is probably the right time to enjoy them, step back from the screens, and let thin liquidity do what it does best confuse people who are trying way too hard.

ES

Weekly expected range: 7060 - 6895

On ES, I am mainly expecting chop with a slight upside bias driven by holiday-thin volume rather than real conviction. Ideally, we see a risk-on push into Tuesday, followed by a sharp rejection on Wednesday that pulls price back toward the 6969 area. From there, the market likely grinds higher again into next Monday. Any meaningful drawdown probably waits until after January 5th, when real volume and real decision-making return.

NQ

Weekly expected range: 26242 - 25469

For NQ, the structure closely mirrors ES. I would like to see upside into Tuesday, potentially tagging the 26097 area, followed by a rejection. On a micro timeframe, the path I am watching is strength into Tuesday, weakness into Wednesday, and then another push higher into the end of the week. That final push should form a lower high, setting up a cleaner downside move once January volume comes back.

RTY

Weekly expected range: 2591 - 2516

RTY looks set for a slow, choppy upside drift that feels more like position-adjusting than aggressive buying. I expect dips to continue getting bought here, at least into the first week of January, with very little urgency on either side.

YM

Weekly expected range: 49383 - 48621

For YM, I am expecting a low-volume grind higher into Tuesday, with a retest of the 49127 area. That level looks ripe for a false breakout, with price slipping back below it by Wednesday. From there, a lower high is likely after a modest bounce into Friday, opening the door for a deeper rejection into mid-January.

SPY

Weekly expected range: 699.37 - 681.25

SPY looks like a slow grind higher for most of the week, with maybe a small dip around Wednesday just to keep things interesting. I expect upside to persist into January 2nd, followed by a more meaningful rejection that should take price lower into mid-January.

SPX

Weekly expected range: 7018 - 6841

SPX is setting up for another low-volume drift higher. Ideally, we tag the 6969 area by Tuesday, reject, and then backtest the midpoint of the recent range. As long as that midpoint holds, price should drift higher into the end of the week. Post January 5th, I expect this upside to reveal itself as a false breakout, leading to a swift move lower.

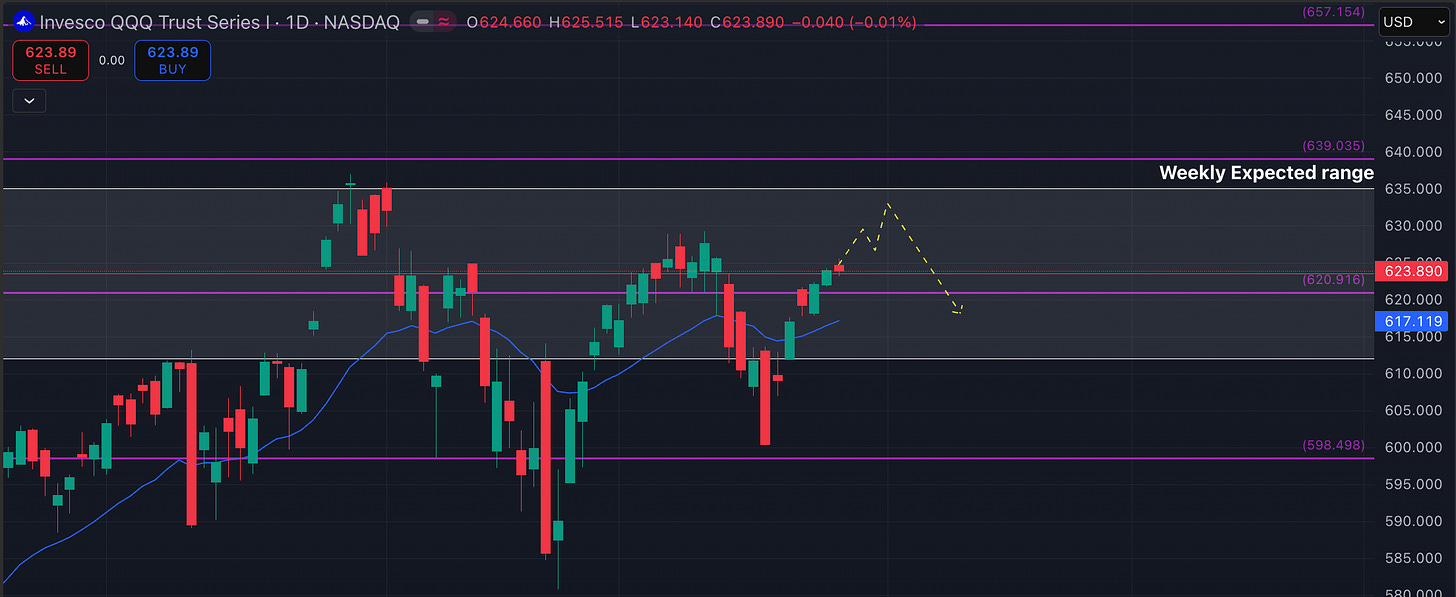

QQQ

Weekly expected range: 635 - 612

QQQ is following the same script as the broader indices. I am looking for another week of slow upside drift with perhaps one risk-off day around Wednesday. As long as dips hold and price remains constructive, a retest of prior highs remains in play.

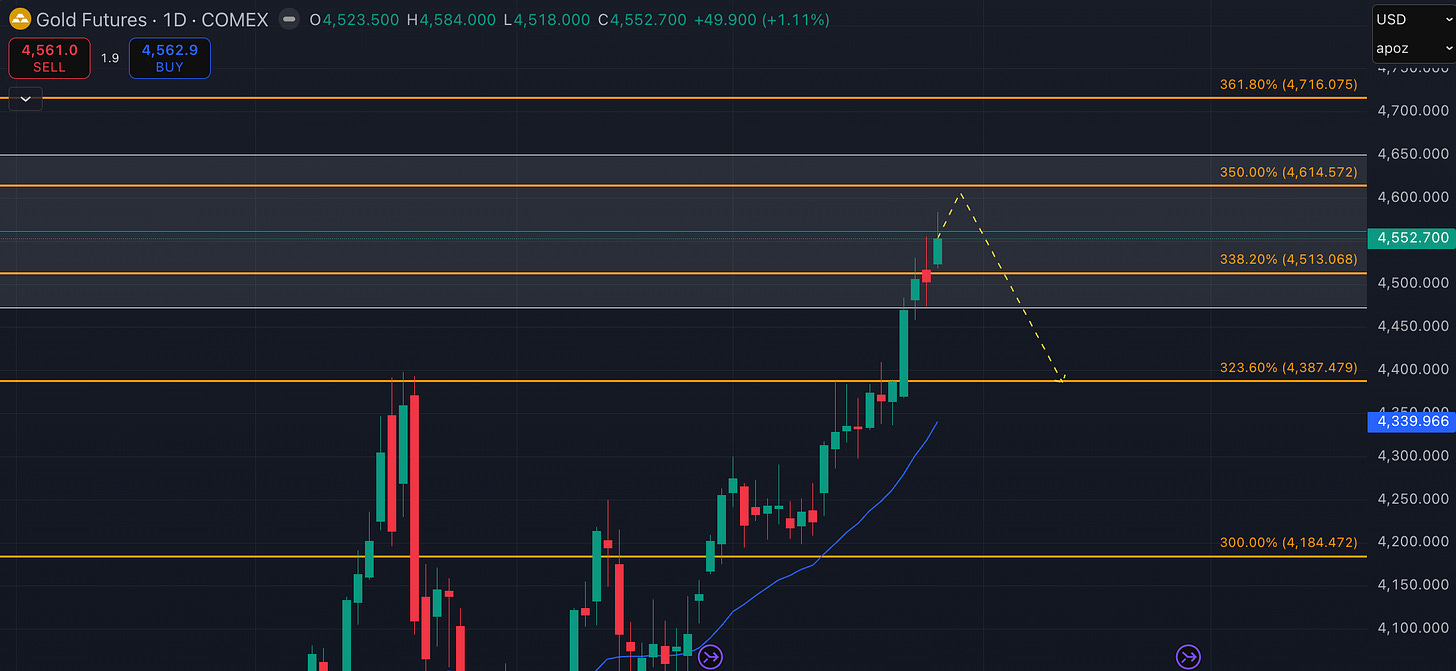

GC FUTURES

Weekly expected range: 4650 - 4475

GC futures are coming off a very clean move from last week, and for this week I am watching for a nasty local top to form. A sharp downside move would not surprise me, but trying to pick tops here is not the move. The only short I would consider is riding momentum intraday if the trend clearly flips.

VX futures

Weekly expected range: 17.85 - 15.77

VX futures may see a small spike early in the week that traps late volatility buyers. From there, a steady grind lower looks likely. Beyond that, volatility should start turning back up after January 2nd as the market transitions out of holiday mode.

TLT

Weekly expected range: 88.66 - 88.62

TLT has followed last week’s analysis almost perfectly, forming a bottom right on schedule. I remain long and continue to expect upside momentum to carry into the second week of January.

ZB Futures:

Weekly expected range: 116.28 - 114.16

ZB futures remain constructive. I am looking for some sideways chop early in the week, followed by a solid low forming by Wednesday. From there, the path higher remains intact.

BTCUSD:

For BTC, this is more of a higher-timeframe view. I expect some weakness early in the week, followed by upside that carries into the early January window. After that, a sizeable pullback into mid-January looks likely, and in my view that zone remains a buy, something I have been consistent about for a long time.

NVDA:

Weekly expected range: 197.33 - 183.73

NVDA looks set for downside early in the week, potentially lasting into Tuesday, followed by a slow grind higher into early January. After that, I expect another failed breakout attempt near 190, with a move to fill the gap around 180 later in January.

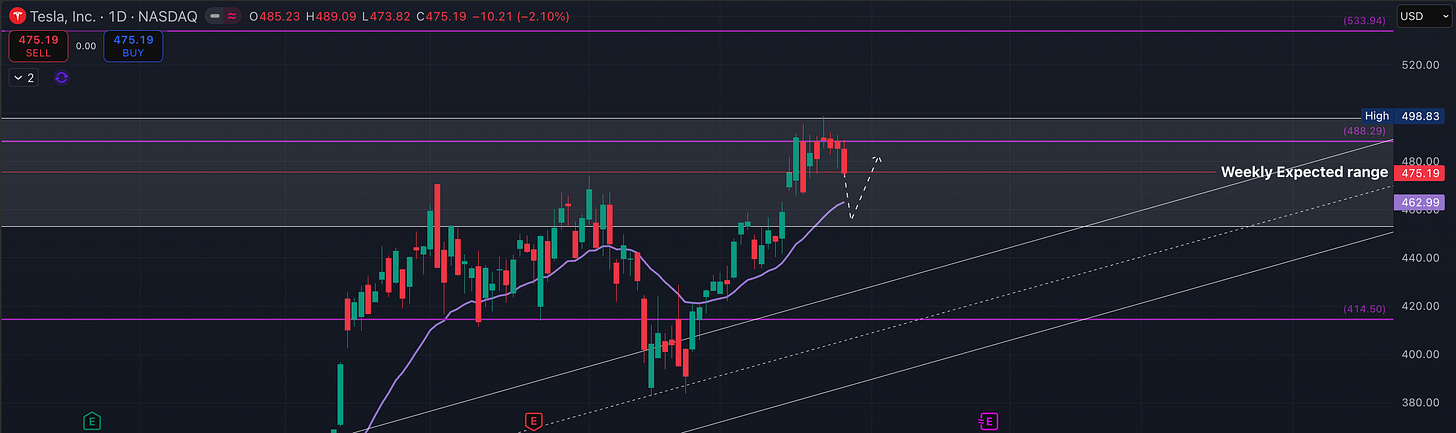

TSLA:

Weekly expected range: 498 - 453

TSLA looks bearish to start the week, with downside into Wednesday followed by a recovery into the end of the week. I expect it to continue chopping within this range before a more decisive move eventually emerges.

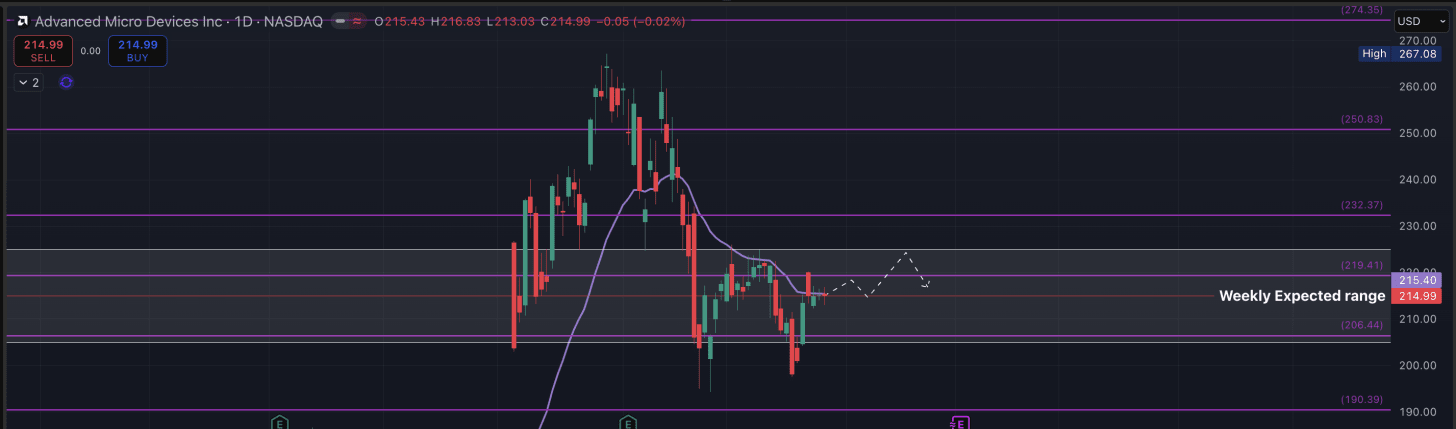

AMD:

Weekly expected range: 225- 205.5

AMD remains in a slow sideways grind with a slight upside bias. Nothing changes here until we see a clean breakout or breakdown, so patience is still the play.

AMZN:

Weekly expected range: 239.24 - 225.8

AMZN’s upside move looks like it is finally pausing. I am watching for strength into the end of December, followed by a sharp rejection into mid-January. The bigger opportunity likely comes later, especially if we see a false breakout that sets up a clean short in January.

META:

Weekly expected range: 682.9 - 643.27

META continues its slow drift higher, and the broader thesis remains unchanged. I expect a sweep of the wick area near the upper channel, and I am still riding the final portion of the position with stops locked in profit.

AAPL:

Weekly expected range: 279 - 268

AAPL has been following the broader roadmap well, but I still do not see a compelling trade. The daily chart hints at a head and shoulders structure, yet for this week I expect early upside followed by sideways action. Still no trade.

GOOG:

Weekly expected range: 324.29 - 305.63

MSFT:

Weekly expected range: 498 - 476

MSFT should stay firm into Tuesday, followed by a sharp rejection on Wednesday that likely gets bought into the end of the week. My broader bias remains short, just not at current levels.

AVGO:

Weekly expected range: 366- 338

AVGO has respected the bottom call almost perfectly and should continue to grind higher. I expect a slow, sideways drift up as buyers remain patient.

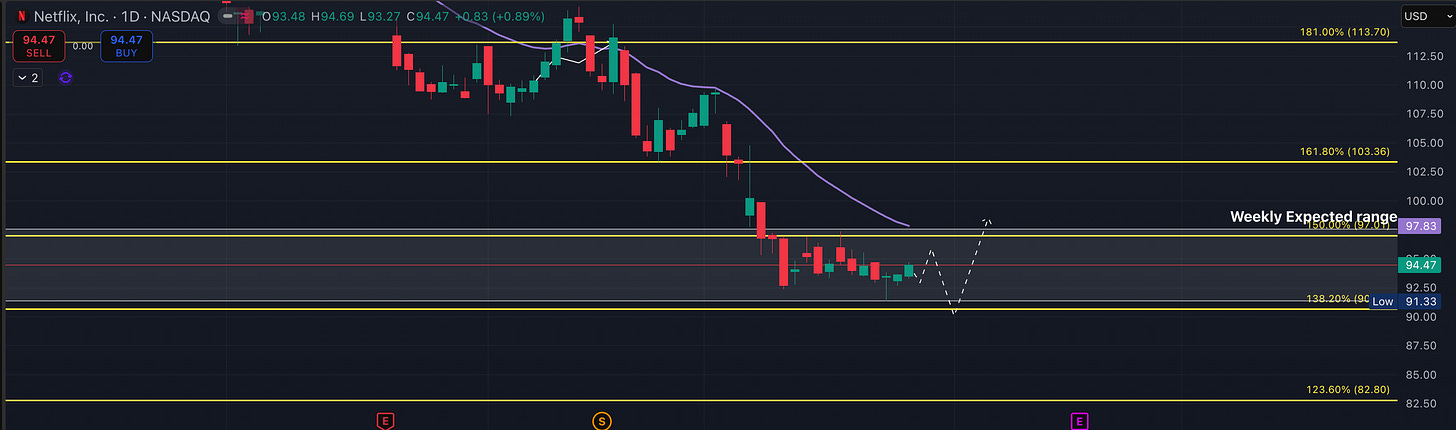

NFLX:

Weekly expected range: 97.59 - 91.39

NFLX remains range-bound. I expect early-week weakness, followed by a push toward the daily 21 EMA that likely rejects. From there, a stronger upside move should emerge later.

To wrap it all up, this is not the week to chase moves or force trades. Thin liquidity and holiday schedules are a terrible combination for overconfidence. Take the mental reset, enjoy the last holidays of 2025, and get ready for 2026, because that is where the fresher and cleaner opportunities will be waiting. And just in case you forgot, this is not financial advice, this is financial improv.

Until next time,

Wicky

Lfg

Thank you for always taking the time to post these weekly updates. You're the real 🐐